The Hawthorne Effect is an academic term referring to the tendency of some people to work harder and perform better when they are participants in an experiment. How does an awareness that I am being watched boost my motivation, affect my decisions and ultimately, improve my results?

If I know you are watching me, I am going to try a little harder and do a little better than if you weren’t.

3 weeks in, this rat in a cage can verify that the Hawthorne Effect is a real thing.

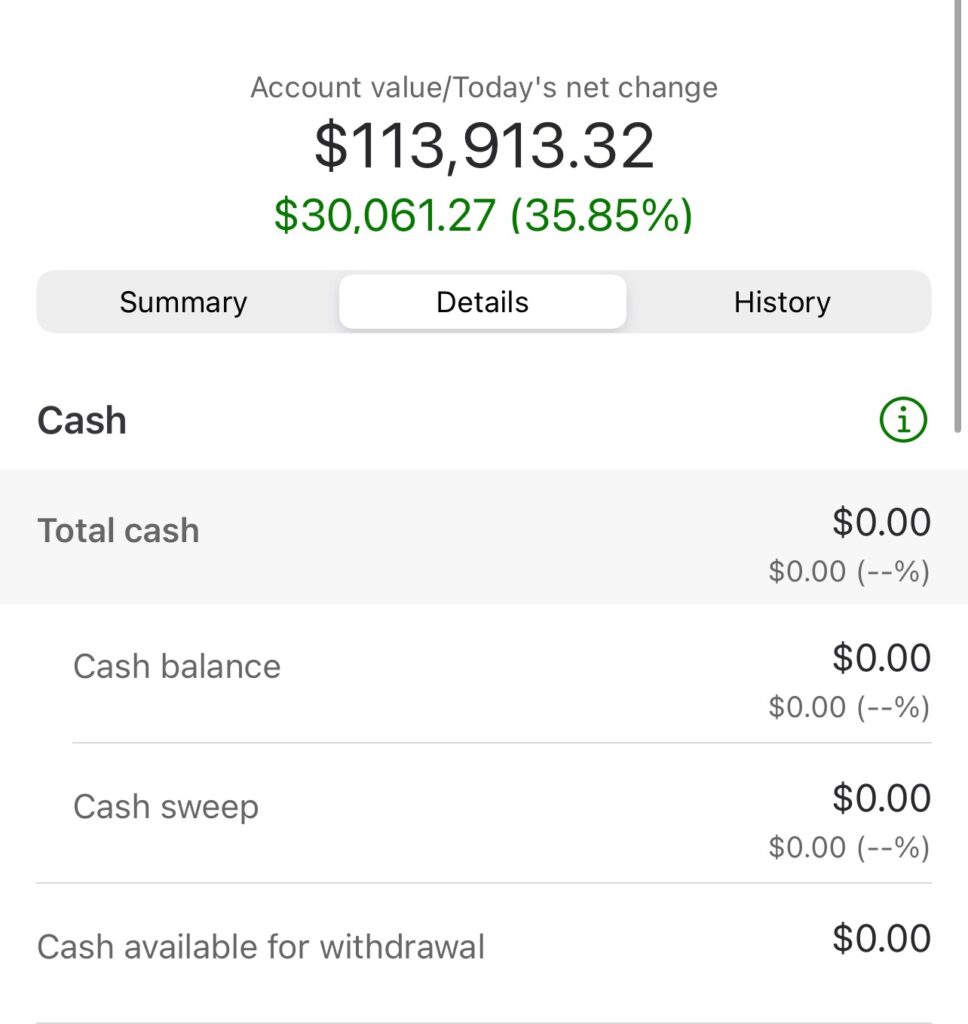

Each Sunday I post these updates – what went well, what did not and what is my goal for the upcoming week, equal to a 1% increase of my account balance from the prior week, leading to $100,000 at the end of 2025 & $200,000 at the end of 2026.

Right now that equates to ~$600-700 per week. Before I began this experiment, I would have weeks with a posted loss and weeks with gains in the $000’s. Now that I am accountable to this blog, there is increased pressure to hit the target number each week, which in turn keeps me contained.

Where once I aimed for $600 per day and would take big swings to generate it, I am now much more focused on posting that $600 gain for the week; put differently, I don’t want to post a weekly loss.

I’d argue that the effect of the Hawthorne Effect has been to reel me in. I am all for it.

So how did this week go? This week was a piece of cake compared to last week.

Inflation numbers came out slightly higher than expected, showing that tariffs may be making their way into the pocketbooks of Americans in a real way. The numbers weren’t so high as to create a panic or major drop, but the Russell 2000 dropped 20 points in the first 2 hours on Tuesday which is a big drop for that index. I was able to cash in on the way down (from 630-8) as well as the way back up around 8am.

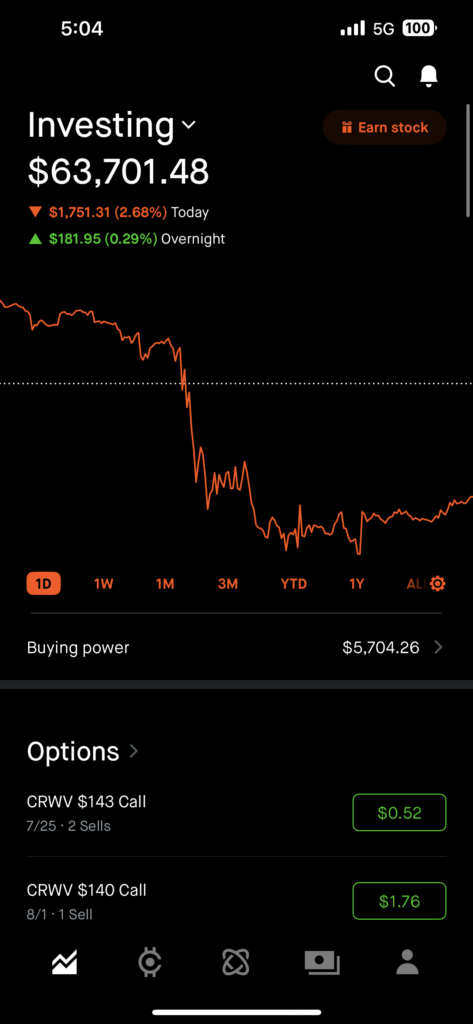

As predicted my CRWV stock rebounded from Monday to Wednesday, regaining all of last week’s losses and finding new highs as well, boosting my account balance back to $65,000 and beyond to $67,000. However, on Thursday and Friday the stock tanked again, finding essentially the same low point as last week and keeping my balance low while profits remain high.

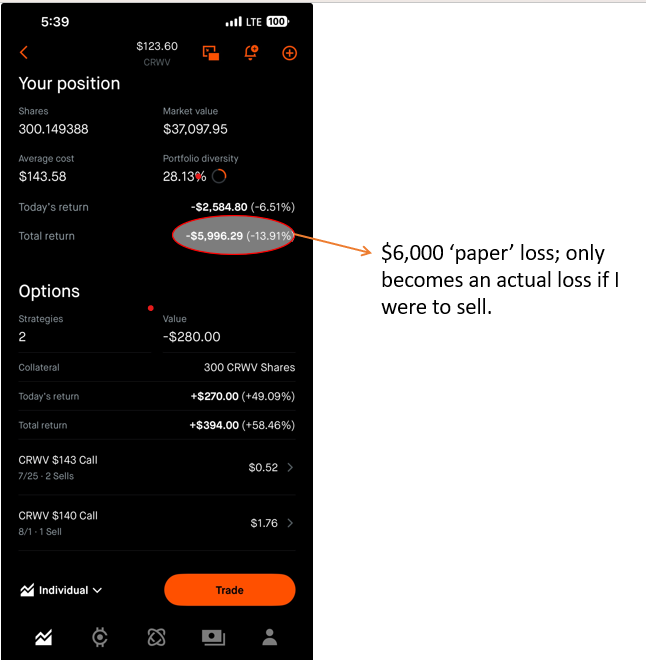

Last week I talked about my perspective on the situation – my experience selling a stock like this too early in the process and the importance of patience. This was my second week watching my profits beat my estimates while my account balance fell behind. As the picture below demonstrates, my current account value of $63,700 would be almost $70,000 if not for this one stock. I am not going to lie, it gets to me. There’s a temptation there to sell it, fueled by a combination of negative emotions:

- Ego – I said this would work, I put it all out there in this forum and what if I am wrong?

- Fear of economic insecurity – if this plan doesn’t work, what’s my plan C? Driving for Uber?

- Greed – I like being able to withdraw a bit each week

- Irrational fear that everything will fail – what if Coreweave goes to $0?

I ran a quick analysis; the data shows my fears are silly.

My current DCA (Dollar Cost Average) for CRWV is $143 and the stock currently sits around $123. But I also got in on the IPO and for the past few months trading CRWV stocks and options I have generated around $7000 profit. So there is money to play with.

Every time I trade an option against it, I aim to profit $200; every time I profit $200, I can factor in a slightly lower price I would be willing to sell it. So over time, $143 becomes $142, $141, etc. So my CRWV exit plan is twofold. First, slowly almost imperceptibly acquire small increments every day, maybe $20-40/day. Over time this will bring my DCA from $143 to say $140. Second, trade options against it in a way that gradually lowers my sell price but still leaves me whole overall. It may look like this for my 300 shares:

| DATE | OPTION | PREMIUM | NOTE | AVE. CRWV PRICE |

| 7.25 | 135 | $150 | 143 | |

| 8.1 | 139 | $200 | 143 | |

| 8.8 | 140 | $225 | 142 | |

| 8.15 | 140 | $225 | ROLLED FROM 7.25 | 141 |

| 8.22 | 139 | $250 | ROLLED FROM 8.1 | 140 |

| 8.29 | 139 | $250 | ROLLED FROM 8.8 | 138 |

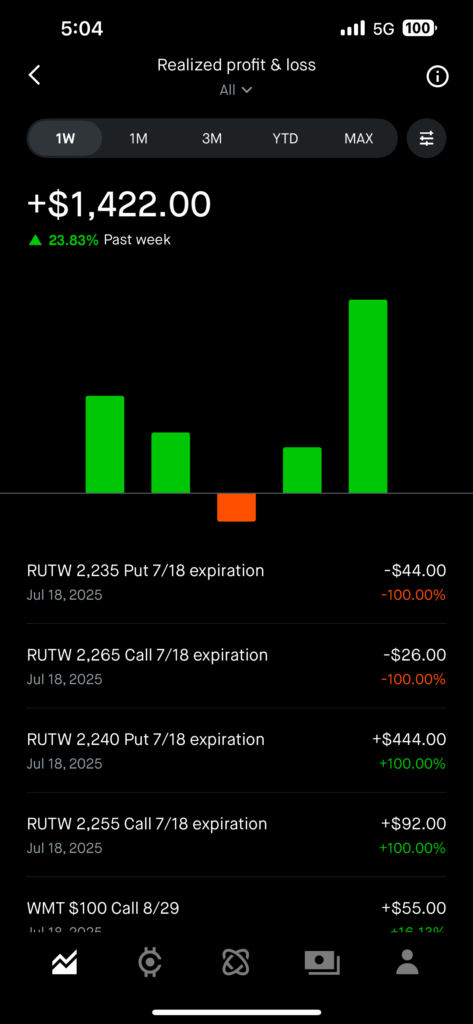

Last Week’s Notable Trades ($1422 profit)

- Repeated CRWV rolls

- Index Trades, including $100 loss on 7/16 & $460 gain 7/18

- Began acquiring JP Morgan due to lack of banking stocks in my portfolio.

Next Week’s Trades:

I talked already about gradually acquiring CRWV and setting up CRWV options on a rolling 3 week basis, so that will be the main focus. The week of 7.28 will most likely be a lower profit week as I focus on setting up August for success. August has 5 Fridays, so I am setting a $4,000 profit goal and an account balance goal at end of August of $72,000 some of which will depend on CRWV as discussed above.

As for the indexes, this week I pushed harder than my comfort level, generating around $800 on the RUT. If you look at my P & L, the lone red is me pushing it a little too far on a RUT trade and losing $100. Nothing has changed; the market is wildly volatile right now between tariff back and forth, crazy budget decisions, even the Epstein Files. If I am going to hit my weekly profit goals I need to play the RUT a bit, but that stops the week of 8.15 if you look at the table of my Covered Calls below. I have a side goal of acquiring 100 shares of IWM so I can play the RUT indirectly but I also have a limited capital stack and CRWV is my focus right now.

Next Week’s Goals

I am targeting a $1,000 profit goal and a $1,500 account balance goal by next Friday. All of this is really going to depend on how my stocks move – especially CRWV, IONQ & QCOM. I am well positioned for the entire month of August, but if those stocks continue to move sideways or even decline, I will have $000’s of value built up in them that I could close for profit.

I have a guaranteed $460 profit from Coreweave alone. If Coreweave stays below $143 which it will, I will probably look at rolling 1 of the 2 options to 8.1 140, meaning I risk CRWV shooting up over $140 and having to sell it at a slight loss. I will then likely roll the 2nd CRWV 143 out to 8.8 at a price where I would not be devastated to have to sell it. As Coreweave continues to languish, I will keep making money each week on options, which over time lowers the amount of money I would ultimately sell it for. At some point I don’t want to have so much of my bankroll tied up in 300 shares but as I wrote in last week’s post, I am also not going to make the mistake of closing for a loss just to watch it shoot back up in a few weeks or months. Patience.

QCOM & IONQ are different stories. I am actually up alot on each of those. They each have deep value left in their options so I’d hate to close early and lose out on it but if CRWV keeps being a drag, I may need to sell some of my profitable positions to free up trading capital. It’s a little bit like killing the Golden Goose though, so want to be cautious.

My updated roster of Covered Calls:

| EXPIRATION DATE | CALLS | PREMIUM | REMAINING VALUE |

| 7.25 | CRWV 143 | $230 (* 2) | $104 |

| 8.1 | CRWV 140 | $214 | $176 |

| 8.1 | IONQ 43.5 | $211 | $238 |

| 8.8 | WMT 97 | $103 (* 2) | $212 |

| 8.8 | SOFI 20 | $120 (* 4) | $312 |

| 8.15 | QCOM 155 | $546 | $685 |

| 8.15 | XOM 110 | $242 | $189 |

| 8.22 | IONQ 45 | $350 (* 4) | $1936 |

| TOTAL | $3759 | $3852 |

I continue to suspect that there is a correction coming to the market in the next few weeks. The Fed will make its interest rate decision on July 30 and Chairman Powell is a lame duck at this point with not only the President calling him names but now his own Board members defecting. It’s pretty sad but what it means for the markets is probably that he cannot make a big enough rate cut at this point to satisfy the markets. I am going to begin to pare some of my holdings and book profits, especially as Covered Calls expire in the money.

As my Covered Calls expire I am going to continue to transition into more stable long-term holdings like COST, O, WMT as well as Oil (DVN, XOM) and Banking (JPM, BAC).

Current Holdings:

| SYMBOL | COMPANY | QUANTITY | PURCHASE PRICE | CURRENT PRICE |

| AGNC | AGNC INVESTMENT | 205 | 9.10 | 9.25 |

| COST | COSTCO | 2.2 | 978 | 951 |

| CRWV | COREWEAVE | 300 | 143 | 123 |

| F | FORD | 500 | 11.40 | 11.15 |

| IONQ | IONQ | 300 | 43 | 46 |

| IWM | ISHARES RUSSELL ETF | 2 | 213 | 222 |

| JPM | JP MORGAN | 1 | 288 | 291 |

| LTC | LTC PROPERTIES | 37 | 35.50 | 35 |

| O | REALTY INCOME | 101 | 56 | 56.5 |

| QCOM | QUALCOMM | 100 | 150 | 154 |

| SOFI | SOFI TECH. | 400 | 17.50 | 21.8 |

| VSAT | VIASAT | 200 | 9.20 | 15.7 |

| WW | WEIGHT WATCHERS | 10 | 33.5 | 36 |

| WMT | WALMART | 200 | 96.60 | 95 |

| XOM | EXXON | 100 | 109 | 107 |

| DATE | BALANCE (BEG) | BALANCE (END) | BALANCE (GOAL) | DEPOSITS | WITHDR. | PROFIT |

| 7/3 | $60,000 | $62,500 | $60,600 | $740 | $1,470 | $1,200 |

| 7/11 | $62,500 | $60,500 | $63,125 | $830 | $0 | $4,900 |

| 7/18 | $60,500 | $63,500 | $65,000 | $850 | $0 | $1,350 |

| 7/25 | $65,000 | $1,000 (GOAL) |

Leave a Reply