In preparing for this blog, I looked at a lot of other sort of “DIY” personal finance blogs – and there are a lot of them out there. Some good, some terrible, some easy to follow and many confusing. I will show you how I use a personal budget to track and grow my wealth, sometimes quickly, sometimes slowly.

Some of my favorite blogs, inspirations for this one include Gordo Byrn’s True Wealth. Fun fact: Gordo won my Age Group at Ironman Oceanside a few months ago. Gordo is an inspiration to me in a few different days – as someone who ditched the 9-5 grind, as an athlete, as an innovator in the performance space and as a person. He also inspired me to turn what was either going to be a triathlon blog or a personal finance blog into a Triathlon/Personal Finance blog.

I first heard him on the Rich Roll Podcast and he introduced me to the concept of 1000 day goals, basically saying that 1000 days is the sweet spot amount of time for goal setting. For this blog and this project, I chose 500 days as my number, maybe I have half the commitment.

While I love his content and want to follow in his footsteps, I also found his blog to be technically very complicated, on both the sports science and the finance side. He very clearly has a brain that works well – but it also works differently than mine. I am a very simple man. Fire bad, Money good.

Another blog I found along the way was Mr. Money Mustache. Lot of good stuff in there, but I found it to be way too much about cutting, cutting, cutting and going off the grid and less about the more practical reality of those of us in-between: still working a ‘main gig’ but preparing for what’s next.

My experience was that these blogs and the dozens like them had a few fundamental flaws:

- They were about cutting expenses beyond the fat, down to the bone;

- They appeared geared towards an audience that had IQ’s of 150, especially when it came to high finance;

- Because of the focus on cutting your own hair, growing crops and dropping your cell phone plan, none of them really detailed how to craft a budget that works for real people.

My budgeting process is a big component of the 18 month plan and I make it as simple as can be, with the first principle of living a good life grounded in reality, as opposed to a monkish existence, while striving to put away as much money into the trading account while I have a steady income.

As part of this 18 month plan, I am working off of an 18 month budget that presupposes keeping my current income for the duration but prepares me in the event I lose my income before December 31, 2026.

The core principles of my budget are divided into 3 layers: (I) The Must-Haves, (II) The Nice to Haves, (III) The Waterfall.

The Budget – Layer I, The Must Haves

- Non-negotiables – rent, utilities, student loan debt. Right now this is around $4000.

- Daily Dollar Amount – Food, gas, Amazon orders, etc. and that number is the same every day for every single month for the duration of the plan. I set this number crazy high, intentionally ($100/day) because this ties into the Waterfall concept below.

- Necessary but Extra’ – haircut, Amazon subscriptions. IRA contributions, a couple of smaller savings accounts I keep for a rainy day. These are items that barely fall into the necessary category but could theoretically be cut back – around $200 per month.

- I then assess Excess or Deficit at the end of the 18 months to help shape the next items.

The Budget – Layer II, The Nice to Have’s

- Weekly contributions – Set 2 weekly automatic transactions; first to my Robinhood trading account ($200/week), then to my Apple savings account ($100/week). The Apple account pays 3.6% interest and serves as a safety account along with a holding account if I am saving up for a big ticket item, like a bike or trip.

- Daily contributions. I set up an automatic daily stock purchase around $30 per day (typically of Costco, but lately acquiring Coreweave, along with $10 per day in my IRA account of O (Realty Income).

The principle of Layer I & II is set it & forget it. Set up as much auto pay & auto withdrawal as possible and don’t get tempted to raise or lower, or worse cancel. The idea is to save on the Daily Dollar Amount and use it towards the Waterfall, described next.

The Budget – Layer III, The Waterfall

I explained above that so many personal finance blogs that I looked into are about cutting expenses to the bone and really making lifestyle changes that are unsustainable for most of us. I am not going to cut my own hair; I am not going to stop eating my precious Rip van Wafel’s each morning; I am not going to ride my bicycle to work to save gas and my wife and I do enjoy eating fairly boug-y meals and taking fairly boug-y trips. That is who I am and what makes life enjoyable.

That said, you can have anything you want in life but you can’t have everything you want in life.

By setting a Daily Dollar Amount that allows for these luxuries, I am rewarded when I skip a few. I get that dopamine hit when I spend 50% less than budgeted because I have a Waterfall plan. A perfect example is food. For years, I ate almost every meal out, especially breakfast. There was something about eating breakfast out that I really enjoyed, especially on the weekends. But breakfast is probably the stupidest meal to eat out, financially. I eat 5 eggs, spinach and chicken sausage just about every day (shockingly, my cholesterol is high). That meal costs around $6 when I make it at home. That meals costs like $26 all in here in San Diego. So, I rarely eat breakfast out anymore. That saves lots of money, but it also carries the added benefit of making the times I do eat breakfast out a special treat.

Coffee is another one. It’s so easy to fall into the Starbucks habit. Click, Order, Pick Up. There is a certain therapy in the daily Starbucks routine. There’s another one that is shockingly expensive, $100-200 per month, depending on the depths of your addiction. Buy a Nespresso; it tastes better anyway.

And on it goes. We all have those little habits, those mindless expenses that add up – maybe you like the instant gratification of Amazon purchases, maybe it’s the mouth pleasure of In n Out, whatever it is. I like my Waterfall system because I get some of that same instant reward but with the twist of long-term benefit.

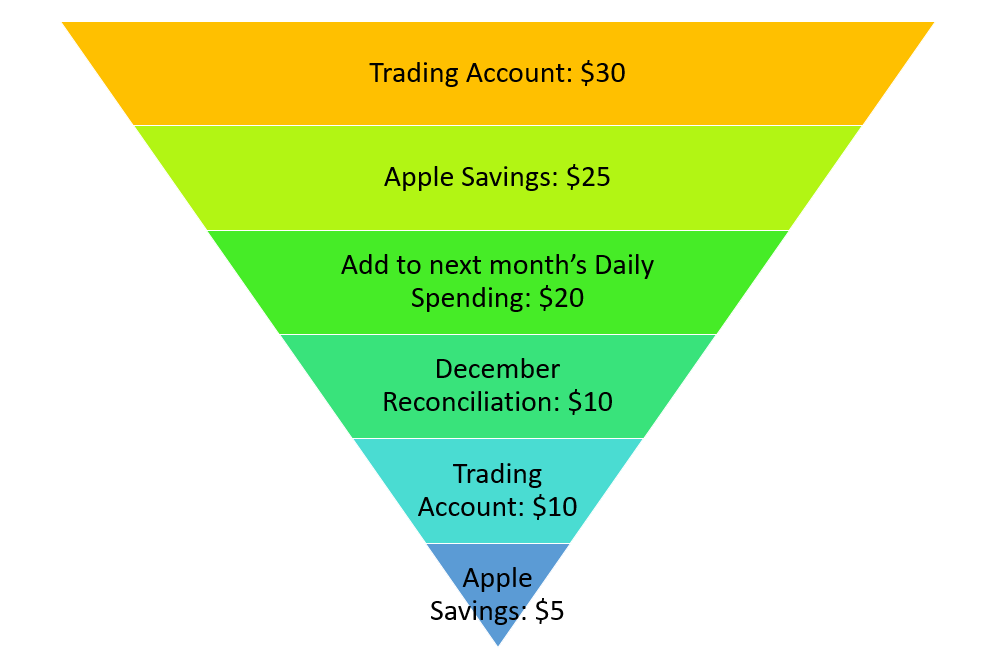

The Mechanics of the Waterfall

So how does it work? After working through Layers I & II above, which are non-negotiable, the Waterfall kicks in. Very rarely do I spend $100 and plenty of days I spend $0. I begin with contributions to the Trading Account, followed by Apple Savings and then adding to next month’s daily spending. This one is important, because psychologically if you boost available spending for next month, the delayed gratification becomes a flywheel. There is a boost in knowing that you have more to spend and by extension – more to save. After working through those 3, I would send a small bit towards a line item in my December budget called Reconciliation. This acts as a backstop against any overspending, but also can be a nice savings contribution if I hit my budget for the year. I have one of these in December 2025 & 2026. From there, the process repeats, as illustrated below.

The Waterfall, Illustrated

So, what’s the point?

I openly acknowledge amongst my friends that budgeting is my addiction and it’s a problem. Hey, there’s the first step. But a benefit of years spent working on this is that I know what works and what does not work. What does not work for me? Budgets that are super restrictive. It’s like a diet where you say I will never eat sugar again or I am only going to eat cabbage. The odds are against you on that one, as opposed to say, doing some of that but allowing a cheat day once a week.

Or closer to my experience – the people that count their days sober have a lower probability of staying sober than those that count in months and then years. I think there are a few reasons why but some of it is based on anxiety and some of it is based on focusing on what you “cannot” do as opposed to what you are doing. In budgeting terms, this is why I allocate a Daily Dollar Amount much higher than what I will spend, probably. This way I am covered as gas prices increase or I end needing to buy something, or frankly if that’s the day I do want to eat breakfast out.

For years I built my budget the other way – I budgeted $0 for each day and just tried to spend as little as possible. That makes you look GREAT on the 18 month basis but it’s grounded in fantasy and essentially disappoints you each day that you spend money, because it turns out we all do need to spend money. Maybe not every day, but definitely every week.

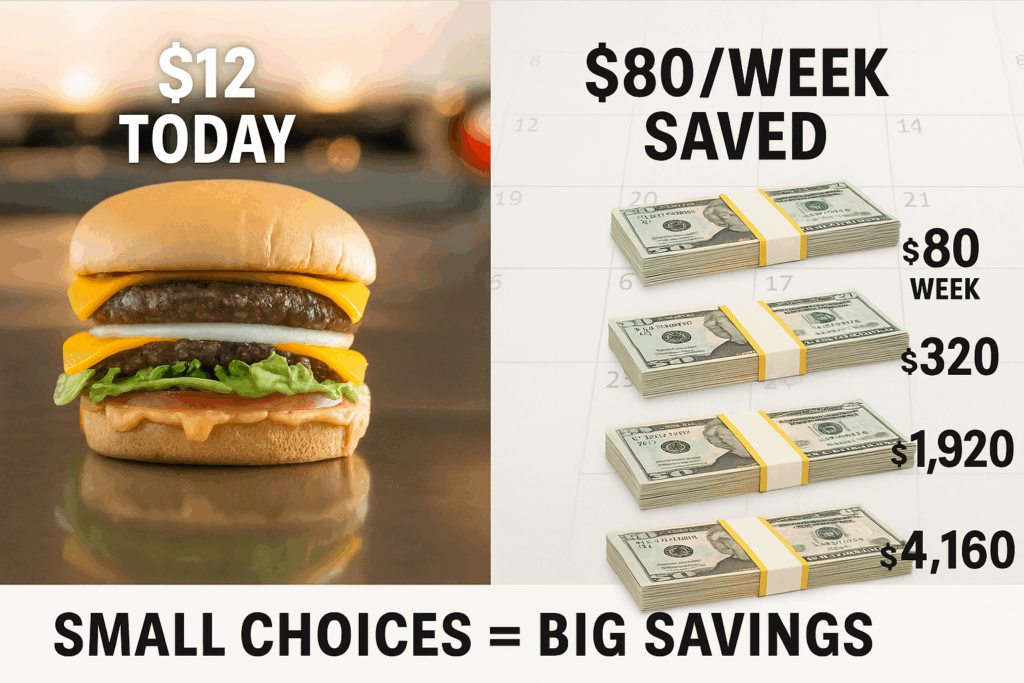

So in the end the numbers I lay out here are going to change for each person. They aren’t important; what is important is the concept. Regardless of anyone’s financial situation, the concept holds. Even if it means putting away $1 per day, do it. I guarantee you will feel better at the end of the month when you have, say $20 in there instead of having eaten 4 extra Double Doubles.

Trust me, I have done both.

Leave a Reply