Each Sunday I post these updates – what went well, what did not and what is my goal for the upcoming week, equal to a 1% increase of my account balance from the prior week, leading to $100,000 at the end of 2025 & $200,000 at the end of 2026. I post my weekly wins & losses with full transparency and my strategies behind generating weekly income through options trading. Follow my weekly updates and improve your trading skills, if only by watching what not to do.

Right now that equates to ~$600-700 per week. Before I began this experiment, I would have weeks with a posted loss and weeks with gains in the $000’s. Now that I am accountable to this blog, there is increased pressure to hit the target number each week, which in turn keeps me contained.

Coreweave

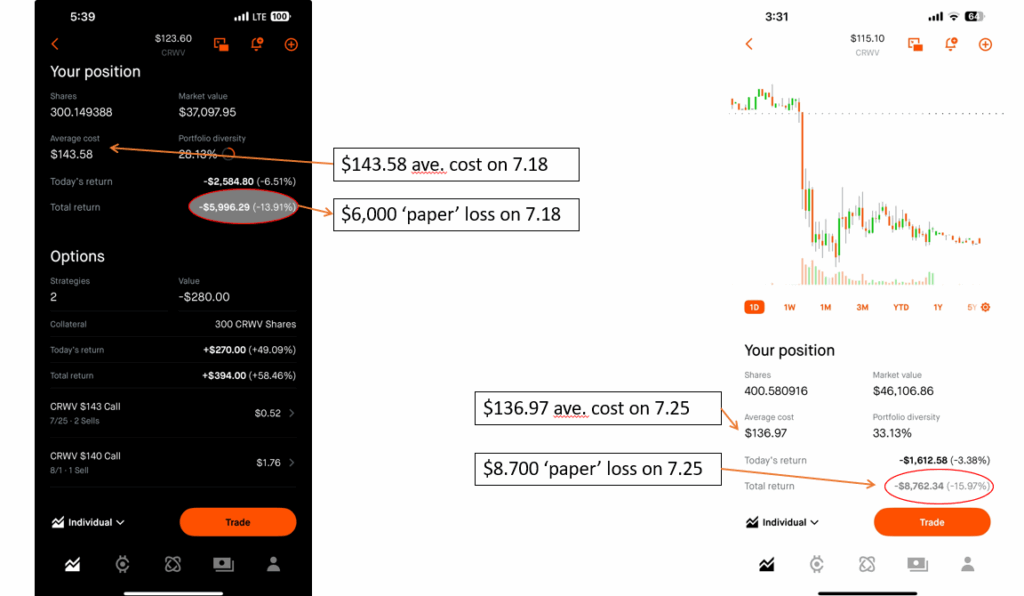

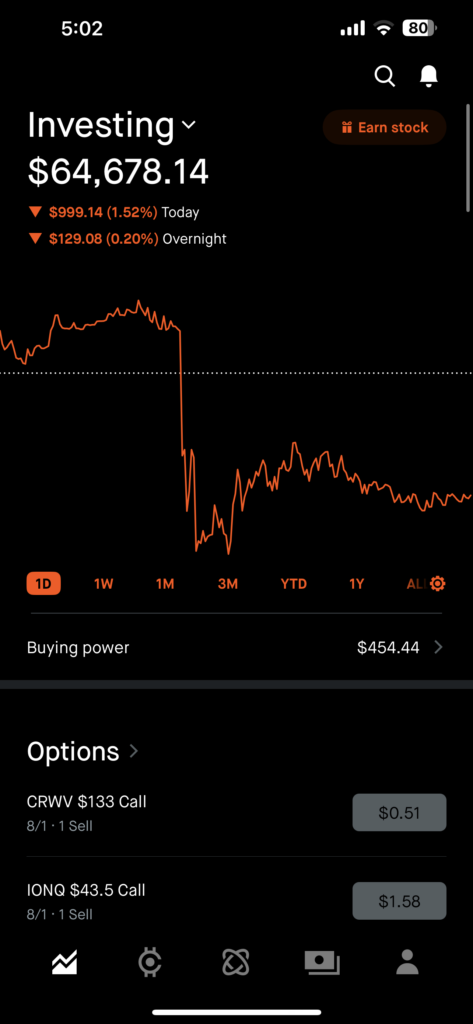

As predicted my CRWV stock rebounded from Monday to Wednesday, regaining all of last week’s losses and finding new highs as well, boosting my account balance back to $65,000 and beyond to $67,000. However, on Thursday and Friday the stock tanked again, finding essentially the same low point as last week and keeping my balance low while profits remain high.

Unlike last week, however, the stock kept dropping. On Friday it hit around $114 and I made the decision to boost my holding from 330 shares to 400 shares, enabling me to trade another covered call against it.

I do not love having one stock occupy such a high percentage of my portfolio but I really am betting that it is just in a slump and between the general AI boom, along with earnings on August 12, this thing will regain its highs and I can get out with a profit.

My current DCA (Dollar Cost Average) for CRWV is $137 and the stock currently sits around $115. Here are my current Covered Call holdings, with plans to roll each one as it expires.

| DATE | OPTION | PREMIUM | NOTE | AVE. CRWV PRICE |

| 8.1 | 133 | $66 | Move to 131 | 137 |

| 8.8 | 135 | $124 | Move to 132; if CRWV stays low, may roll this to 131 on 8.15 | 137 |

| 8.12 | EARNINGS | AFTER | THE | BELL |

| 8.15 | 136 | $332 | Roll to 133 | 136 |

| 8.22 | 134 | TBD | WILL ROLL FROM 8.1 | 136 |

| 8.29 | 135 | $405 | 135 |

Table presumes CRWV stock price between 115-125; add ~.5 shares per week. Watch for earnings on August 12. Could be a bloodbath.

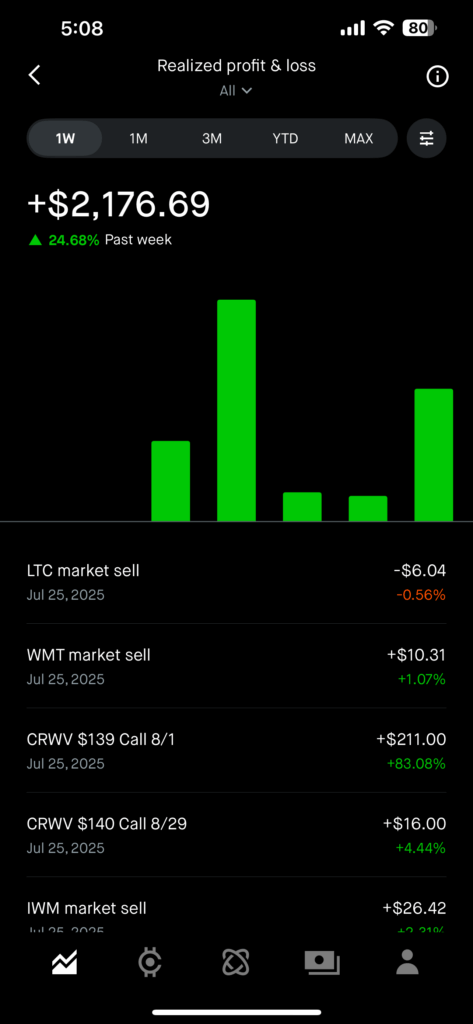

Last Week’s Notable Trades ($2176 profit)

- OPEN – This week the meme stock craze was revived a bit as speculators and the Wall Street Bets crowd dove into Opendoor Technologies. (If you are not familiar with WallStreetBets please for the love of all that is good and sacred in this world, begin with this thread of a man who claims to have lost $1m trading options, only to get absolutely shredded in the comment section). The stock went from .76 on July 11 to 4.71 on July 21. That 650% in 10 days. I am sure a lot of people made a lot of money. Also a lot of people have lost a lot of money as the stock is now back to 2.50 as of July 25; I am guessing people bet big at a point that was too late and are now stuck in the position that may or may not ever go back up. Opendoor Technologies is not necessarily a stock that you want to hold long-term, especially since the Nasdaq threatened to delist them as recently as May 30. I sold Put options on the way up and made a few hundred. Also, like a dumb dumb I broke down and bought 200 shares at 4.32, thinking the high times would never end. Now the stock is at 2.50, the high times probably ended and I will sell Covered Calls against it until it inevitably heads back to .75 and oblivion. This is why I don’t trade meme stocks.

- CRWV – I covered my CRWV saga in depth above. Needless to say, I dropped my average cost from 144 to 137, made a lot of profit rolling Covered Calls and will continue to acquire small bits until I am able to bring my cost down closer to 135. Along the way, though I am also going to begin writing Covered Calls around 132, maybe 131 because I am willing to risk a few hundred dollar paper loss in exchange for shedding 100 shares and making more Covered Call premium.

- RUT – Highly profitable week on the RUT ($1,250), including an $800 gain at the buzzer on Tuesday.

Next Week’s Trades:

This week I will be rolling CRWV calls to set up a strong August and the potential dump of 100-200 shares at ~$130. My objective is to do this on a strong week so the loss doesn’t ruin a good week.

Fed Meeting

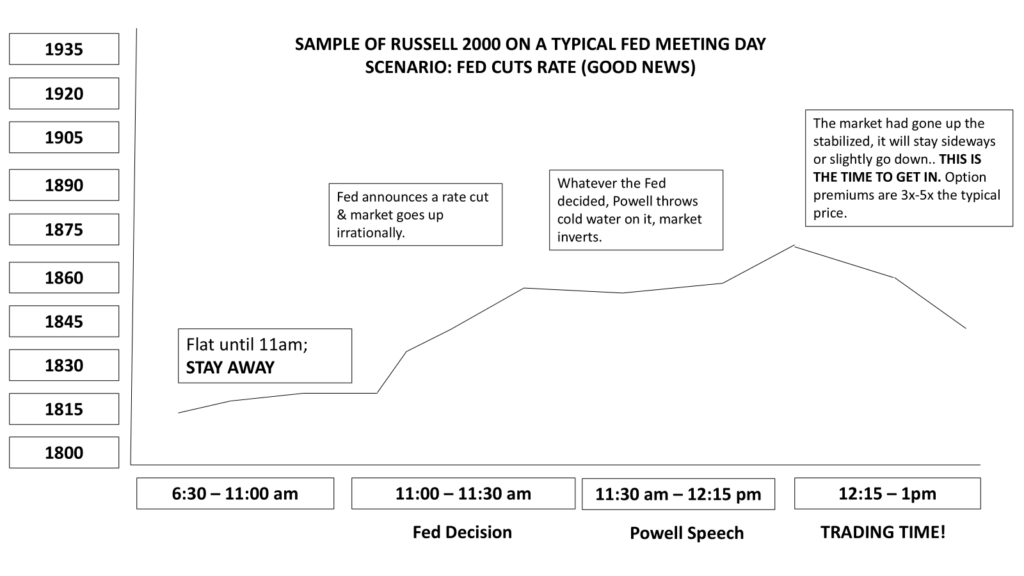

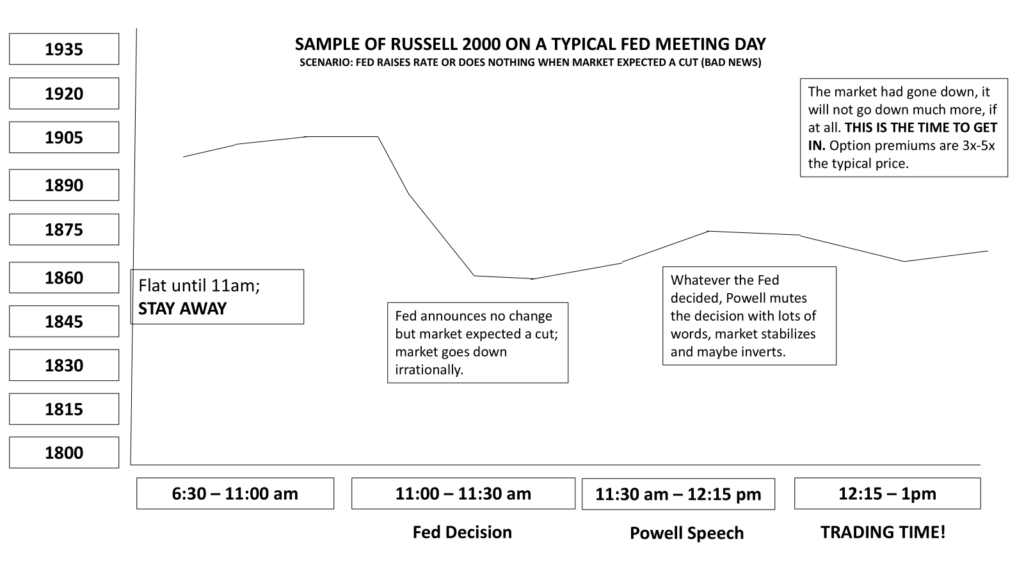

The Fed Meeting will take place Tuesday & Wednesday this week, with their announcement at 11am pacific Wednesday followed by the Powell press conference at 11:30.There is a 95%+ probability that rates will hold steady in August, so what the market will really be watching is Powell’s press conference. There is some debate if the Fed will make 2 or 3 (or less) cuts in 2025, with consensus being that they will cut no less than twice, possibly 3 in September, October and December.

I trade VERY cautiously but very predictably around the Fed Meeting. Typically the pattern looks like this, in my experience:

Next Week’s Goals

I am targeting a $650 profit goal (1%) by next Friday. It’s very low, intentionally. First, I am low on available trading balance because I bought another 100 shares of CRWV. Second, I am positioned incredibly well for the rest of August (almost $4,000 in Covered Calls) and don’t want to make any risky trades.

Really, my account balance at the end of the week will depend on CRWV. There is a potential scenario where I generate another $500-1000 profit, deposit $500 and still end up down. I am well positioned for the entire month of August, but if those stocks continue to move sideways or even decline, I will have $000’s of value built up in them that I could close for profit.

My updated roster of Covered Calls:

| EXPIRATION DATE | CALLS | PREMIUM | REMAINING VALUE |

| 8.1 | CRWV 133 | $51 | $61 |

| 8.1 | IONQ 43.5 | $211 | $158 |

| 8.8 | CRWV 135 | $124 | $130 |

| 8.8 | WMT 97 | $103 (* 2) | $250 |

| 8.8 | SOFI 20 | $120 (* 4) | $264 |

| 8.15 | CRWV 136 | $332 | $298 |

| 8.15 | QCOM 155 | $546 | $418 |

| 8.15 | XOM 110 | $242 | $242 |

| 8.22 | IONQ 45 | $350 (* 4) | $1460 |

| 8.29 | CRWV 135 | $405 | $398 |

| TOTAL | $3759 | $3679 |

As my Covered Calls expire I am going to continue to transition into more stable long-term holdings like COST, O, WMT as well as Oil (DVN, XOM) and Banking (JPM, BAC).

Current Holdings:

| SYMBOL | COMPANY | QUANTITY | PURCHASE PRICE | CURRENT PRICE |

| AGNC | AGNC INVESTMENT | 205 | 9.10 | 9.71 |

| COST | COSTCO | 3.3 | 978 | 936 |

| CRWV | COREWEAVE | 300 | 137 | 115 |

| F | FORD | 500 | 11.40 | 11.15 |

| IONQ | IONQ | 500 | 42.77 | 43.17 |

| JPM | JP MORGAN | 1 | 288 | 291 |

| LTC | LTC PROPERTIES | 8 | 34.89 | 34.89 |

| O | REALTY INCOME | 101 | 56 | 56.5 |

| OPEN | OPENDOOR | 200 | 4.32 | 2.49 |

| QCOM | QUALCOMM | 100 | 150 | 158.77 |

| SOFI | SOFI TECH. | 400 | 18.27 | 21.24 |

| VSAT | VIASAT | 300 | 14.83 | 14.60 |

| WW | WEIGHT WATCHERS | 10 | 33.5 | 40.90 |

| WMT | WALMART | 200 | 96.60 | 97.42 |

| XOM | EXXON | 100 | 109 | 110 |

| DATE | BALANCE (BEG) | BALANCE (END) | BALANCE (GOAL) | DEPOSITS | WITHDR. | PROFIT |

| 7.3 | $60,000 | $62,500 | $60,600 | $740 | $1,470 | $1,200 |

| 7.11 | $62,500 | $60,500 | $63,125 | $830 | $0 | $4,900 |

| 7.18 | $60,500 | $63,500 | $65,000 | $850 | $0 | $1,350 |

| 7.25 | $63,500 | $64,600 | $65,000 | $540 | $0 | $2,176 |

| 8.1 | $64,600 | $66,000 |

Leave a Reply