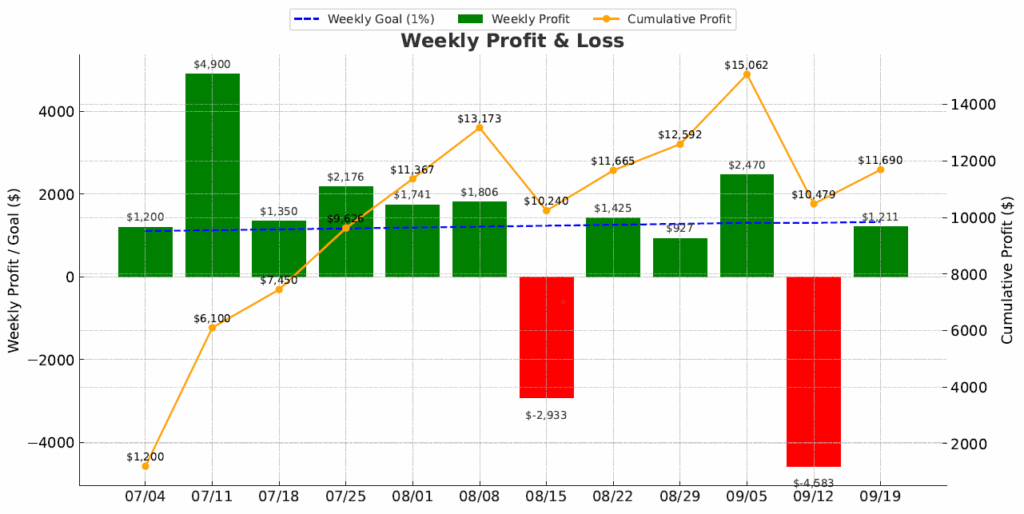

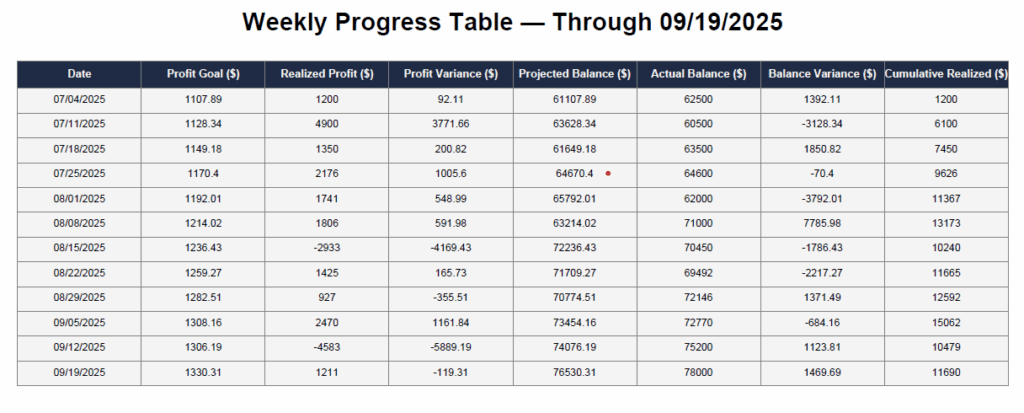

Weekly Profit: $1,211

Weekly Profit Goal: $1,388 (-$177 variance)

Opening Account Balance: $75,200

Ending Account Balance: $78,000

Ending Account Balance Goal: $76,588 (+$1,412 variance)

Next Week’s Profit Goal: $1,396

Next Week’s ending Account Balance goal: $79,400

Most things in my life end in a better result if I take my hands off the wheel.

Trading stocks and options is one area.

I make money in 4 ways: (1) Options Premium – +90% of my profit, (2) Stock Gains – +5% of my profit, (3) Trading conservative options on the Russell 2000 – +20% of my profit, (4) Trading risky options at the market buzzer – -15% of my profit/losses.

That #4, that’s a negative. Wealth preservation being a strategy too that I am ignoring, we will dive into the psychology of risky options trading later in this entry.

Week in Review

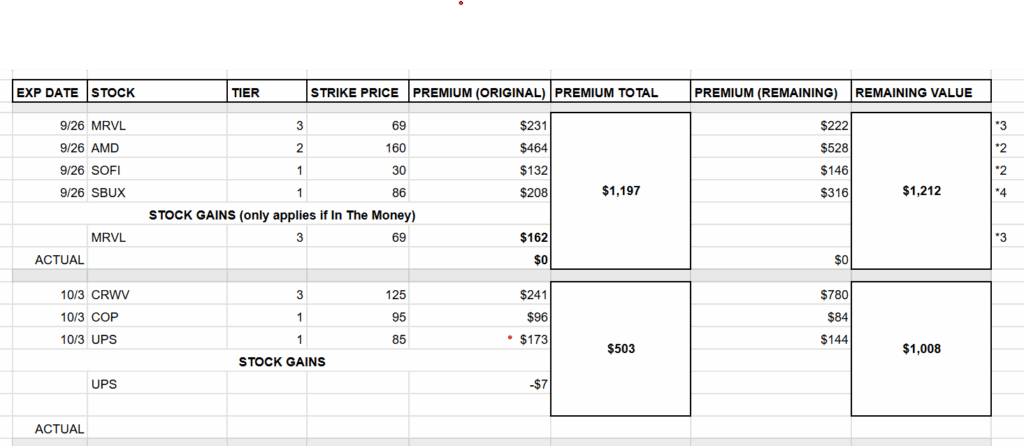

The title says it all – everything just worked. Went into Monday with a set roster for the week that projected $1,200 in gains and the market obliged, rising virtually every day, several of my covered calls were exercised and most others I either closed early or rolled (AMD).

Made another $500 in conservative Russell 2000 trades; this being a Fed meeting week I was highly cautious leading up to the meeting on Wednesday.

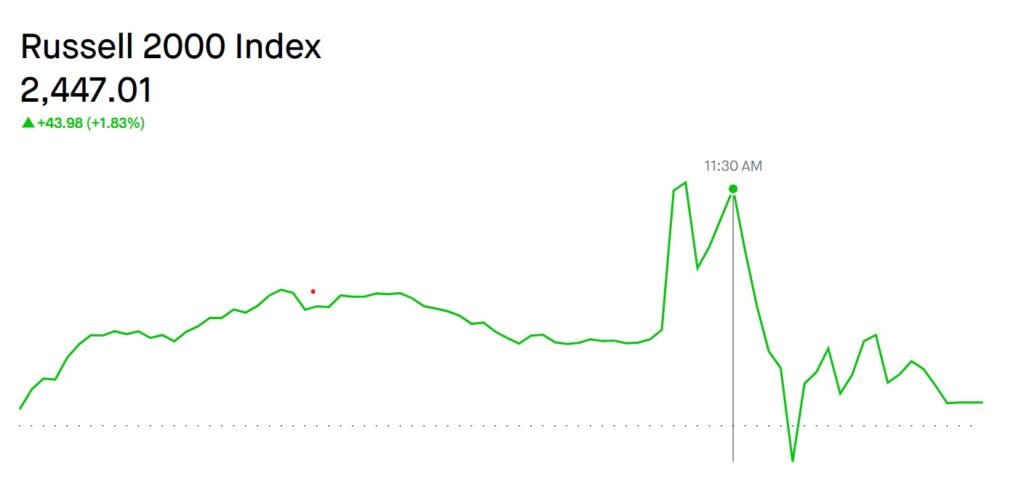

Even made money playing the old familiar pattern on Fed Meeting Wednesday: bet against Fed Chair Powell’s speech. Like clockwork, sell call spreads at 11am when the Fed announces a rate cut and you can sell them for a huge profit by the time he’s done with his speech because he throws cold water on the flames.1

So by end of day Wednesday I was looking at a $2,000+ profit for the week. Great time to just stop.

But I don’t stop, do I?

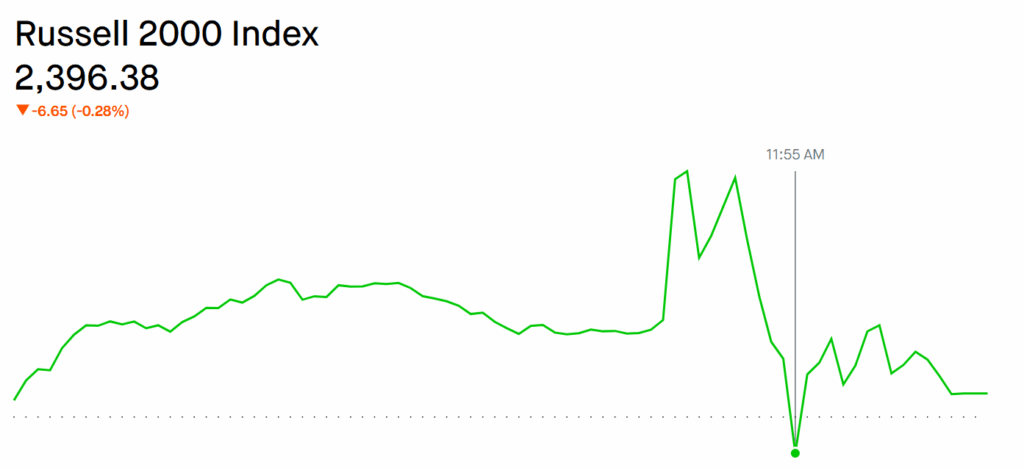

On Thursday the market was frothy, rising pretty much all day, a bit irrationally to my way of thinking.

I can trade the RUT in 2 ways, Conservative or Risky. I have years of data from my personal trading logs that confirm that Conservative RUT trading yields around $120 per day with a 95% success rate. And that Risky RUT trading yields around $10 average per day because it has around a 70% success rate. The losses are so great that they wipe out the gains.

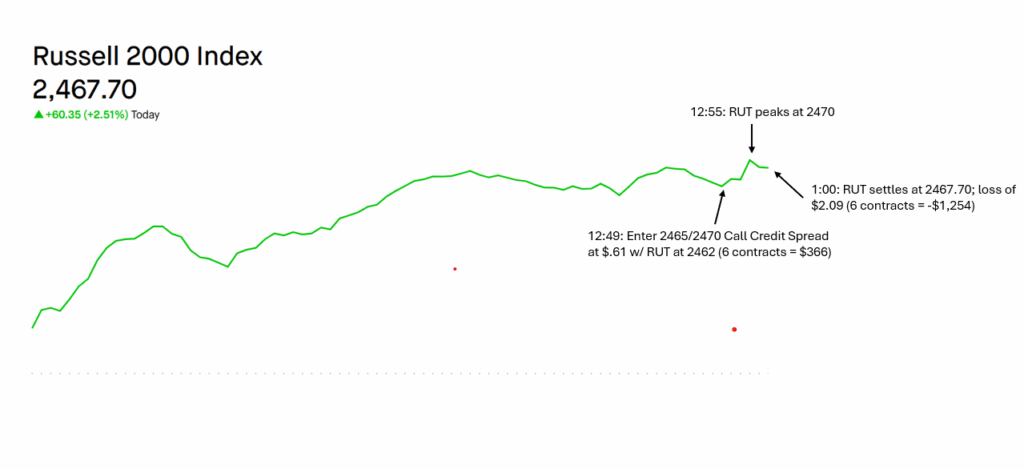

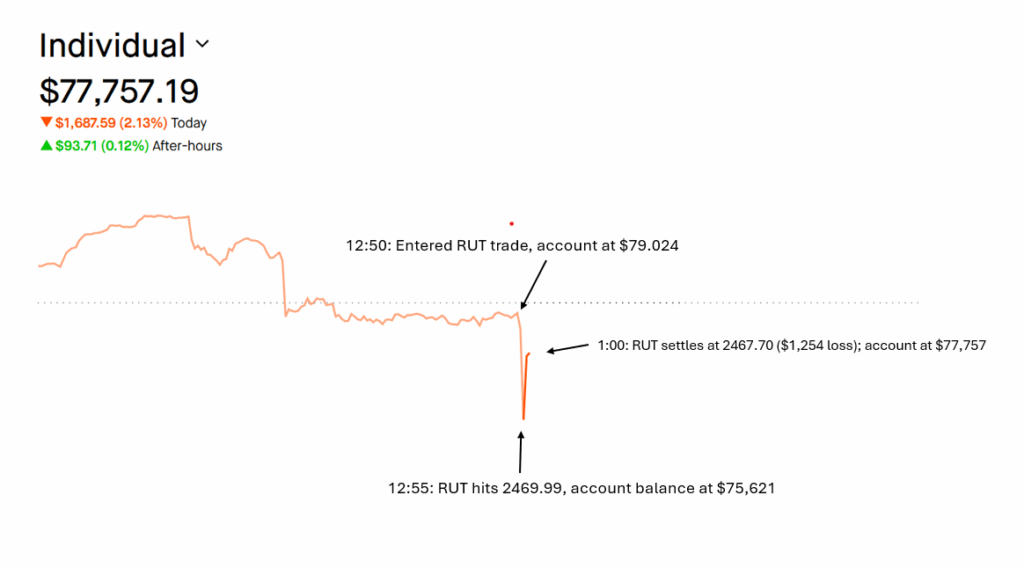

Anatomy of a BAD Trade

12:49: Market seems overbought (RUT at 2462) and I look for the RUT to drop a few points or at least stop its upward trajectory. Get into 6 contracts of $.61at 2465/2470, meaning I can make $366 (6 x 61) or lose $3000 (6 x the difference between 2470 & 2465). I am looking for the number to stay at 2462, drop or at least not go over 2465.

12:55: Almost immediately the number shoots up, hitting 2470 at 12:55.

1:00: The number teeters a bit but settles at 2467.70. This means I get the gain of $366 but a loss of $1,620 for a net loss of $1,254.

As Albert Einstein, or Al E in AA once said:

Insanity is doing the same thing over and over and expecting different results.

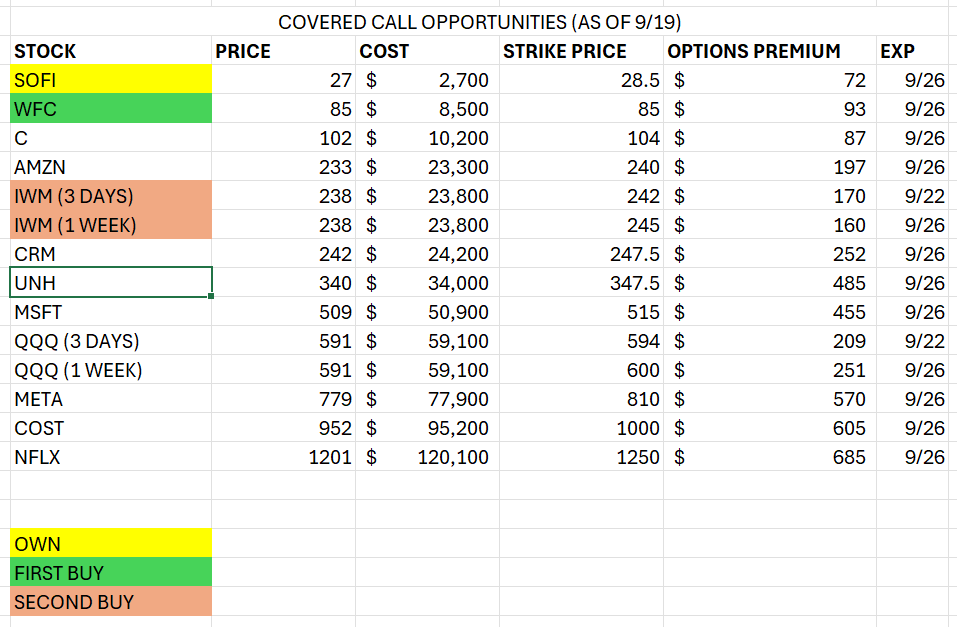

Week of 9/26

I was in wait and see mode leading up to the Fed Meeting; it turns out I could have bought leading up to it and made a profit as everything went up, but that’s OK – everything I do own went up and my account balance with it.

This week I am looking ahead to October which is a bit light right now. I did increase my VSAT holdings to 600 and sold 6 contracts for 10.17; if you want a nice return for little investment, I recommend VSAT 31 calls. VSAT is trading at $29.80 and a 31 call returns $2.05 right now.

I did get back into SOFI after turning a nice profit on it over the last few months; I got in at 27 and sold 28.5 options for $72 each. SOFI is currently trading near 30, so should get called out this week.

In the name of keeping a more balanced portfolio, looking at adding Wells Fargo (WFC) this week, which turns in decent premium for a Tier 1 bank stock – $93 for a one week call.

In the name of not repeating the same mistake over and over with the risky RUT trades, there is another way – buy the IWM and trade 3 day options on it. The IWM is an ETF that tracks with the RUT. It’s essentially the benefit of trading the RUT without the risk. The return is lower – around $60 per day or so, but unlike trading the RUT (a cash trade) you can never lose your cash because you own the asset. The drawback is price – $24,000 to get in and I currently have around $8,000 to play with, so I will be saving my nickels and dimes this week.

- Note: The opposite is also true. If the Fed announces no rate cut and the market drops, his speech will usually take an optimistic tone and rally the market. ↩︎