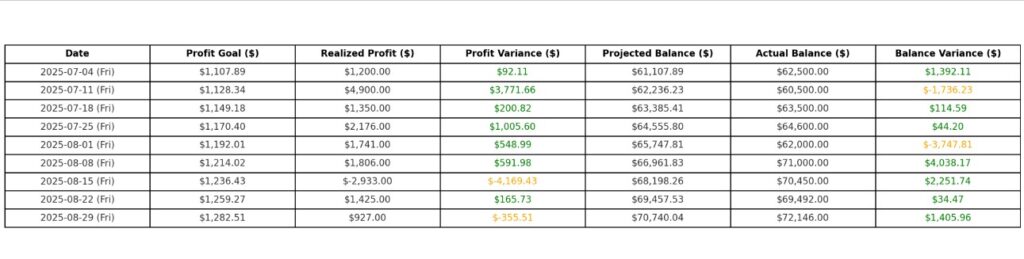

Weekly Profit: $927

Opening Account Balance: $69,492

Ending Account Balance: $72,146

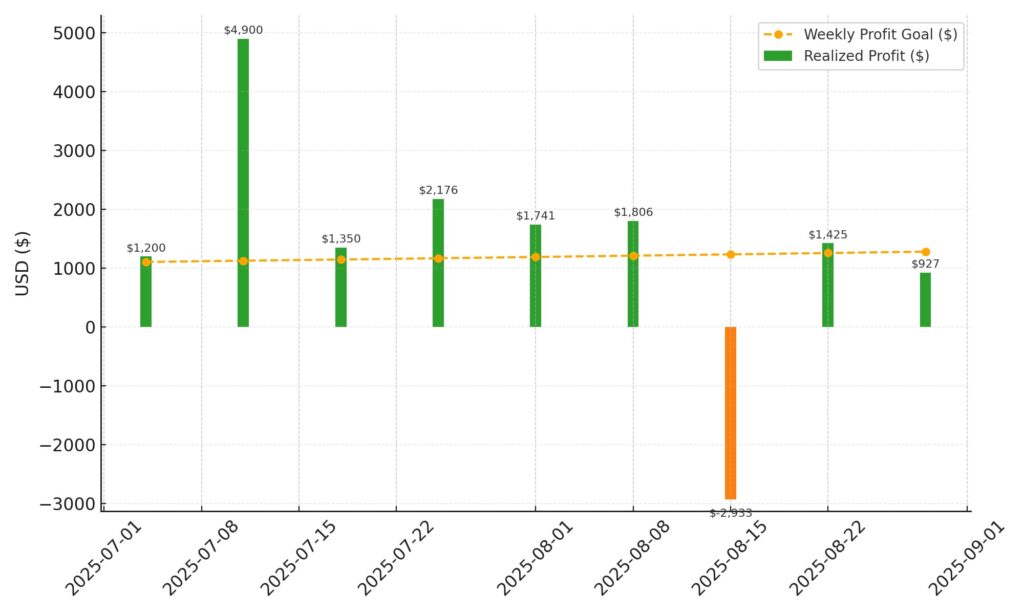

The 9th week of a 73 week process (~ 12%) is sort of mile 4 of the marathon. You’re warmed up, you’ve made the mistake everyone makes of going out too fast (or too slow), you’ve found your pace and you’re staring at the daunting prospect of another 22 miles of this. Or in the curious case of the 18 month plan – another 64 weeks.

Mile 4 is also about the time you take stock (pun intended); what is going well, what isn’t, what real-time adjustments need to be made.

In this case, it’s taken me 9 weeks to make the tweaks I needed to make to stay on course:

- Reduce reliance on 1 or 2 stocks (CRWV, IONQ) or sectors (AI / Tech)

- Shift focus from Account Balance to Weekly Profit

- Create adaptive projections that automatically update the remaining weeks based on the current Profit & Account Balance

- Craft spreadsheets and tables that just need to be updated each week

Last Week’s Profit: $927

Last Week’s Notable Trades

I got into MRVL on Monday on an earnings play as they reported Thursday. The stock had been down around 20% this year from its 50 day moving average, so I got in at 72 and most predictions have it hitting 90-100 within the next 12 months, so it’s a stock I am comfortable holding. It didn’t hurt to get $300 in options premium for 1 week.

Earnings met expectations, but the narrative in the earnings call was pessimistic, so the stock dropped to 62. I got into another 100 shares and rolled 2 calls out a few weeks, one on 9/29 and the other 10/19. I am happy to hold 200 shares, but no more; confident it will go back up but do not have the appetite for another CRWV.

Speaking of CRWV, NVDA reported earnings on Wednesday. The market had priced in PERFECT earnings as the stock has risen 300% and that really left the market with no room for anything but disappointment. Even though the earnings were amazing, the stock fell – and by extension so did my AI holdings – CRWV, IONQ, MRVL.

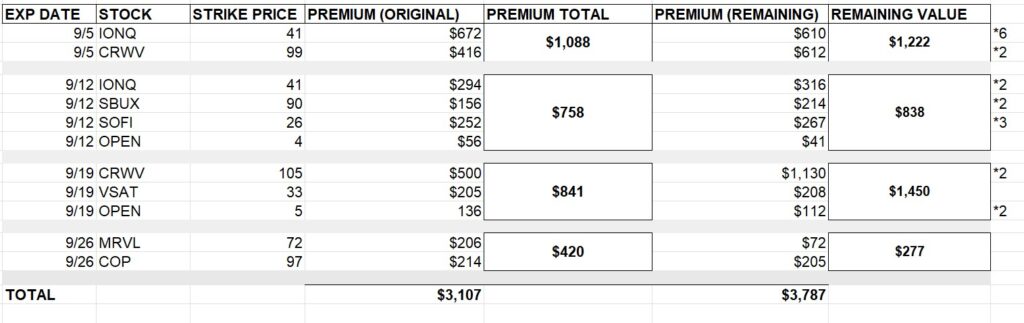

As typically happens, though, all of those holdings crept back up on Thursday and Friday. As of now, I am slated to get called out of 200 CRWV & 600 IONQ on Friday. I will take a paper loss on CRWV, but will still own 210 shares with an average price around $95, meaning I will own very profitable shares. Similar situation with IONQ.

Next Week

On vacation for the week in Puerto Rico. I set week this week already so there isn’t much to do. If CRWV & IONQ stay in the money, I collect $1088 in premium, but will take a paper loss as I shed my more expensive CRWV shares. If CRWV and/or IONQ fall out of the money, I will roll them out a few weeks.

I have too much experience trading stocks on vacation to know it doesn’t serve anyone and I made a commitment to my friends and to my wife to leave the RUT alone this week. Because my accountability buddy Chris knows me so well, when I told him of my commitment, he responded with “how about you commit to not checking it obsessively like you usually do”. It’s good to have friends who know you.

Recommended Trades

9/5: MRVL 64. You could get in on a distressed stock at a discount and worst case make $200 ($100 in options premium, $100 in the jump from its current price of 63).

9/12: UNH 315. Another stock I don’t mind owning. Currently trading at $309l so a 9/19 315 call nets $1,115: $515 in options premium plus another $600 in the jump from its current price.

9/19: VSAT 33: $280 in income from a cheap stock. VSAT is a stock for a good reason (great options premium for such a low price) and a less good one (they are down the street from me). Buy 100 at $32.20, sell a 9/19 VSAT 33, make $80 on the price jump and $200 on the options premium. But, be prepared to own this one for awhile as it’s trading around its 50 day moving average ($29.92) and could be due for a fall.

September

Looking ahead, the next Fed Meeting is September 16 & 17. The market is fully expecting a rate cut and will be looking for an indicator of more to come. God forbid there is no rate cut, the market will plummet. Should Powell indicate caution or sound notes of no more cuts this year, expect a big dip. There is more reason for caution and moving into safer stocks like Consumer Staples and Banking until we know more.