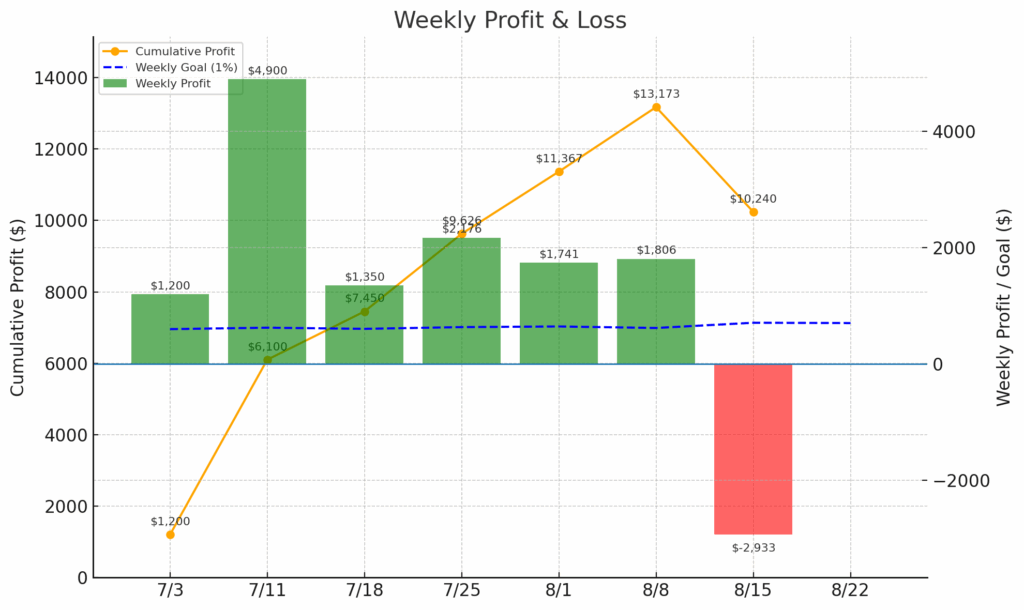

This 7th weekly update is by far the most unique and consequential to date.

This is also the first week I have posted a loss. In trading and life, there is far more value in losses than wins, so let’s explore what led to this loss, in-depth.

What new rules came out of this week’s learnings?

- Write down your rules.

- No one stock should make up more than 10% of your account.

- Don’t trade unless you’re making a good trade for a good reason.

- If you’re emotional about trading, walk away. If you are still emotional after 15 minutes, run away.

1. Write down your rules.

I do not have a totally comprehensive set of rules or guidelines written down. Some I do, some I don’t. Sometimes I just know when I am going against my system.

Even a dog knows the difference between being kicked and being stumbled over.

- Oliver Wendell Holmes

The 1% system is based on a few tentpoles – (i) carefully selected covered calls, (ii) trading the Russell 2000 at specific times and based on specific criteria, (iii) monthly dividends, (iv) judicious use of margin as leverage. Conceptually it is also set up to set it Monday morning at 6:30am and forget it until Friday. Conceptually.

Stay within these tentpoles and it is fairly easy to generate 1% return per week.

Generate 1% return per week and the day comes you don’t have to work a W2.

It’s pretty simple. Until it’s not. So let’s look at 2 key mistakes this week.

2. No one stock should make up more than 10% of my account.

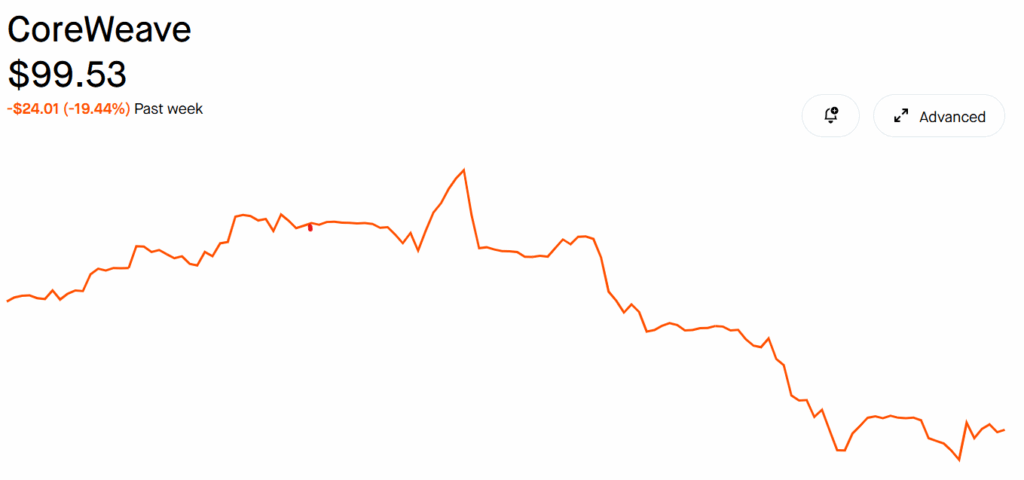

I have written way too much about Coreweave and dive into it later in this post, but at one point that one stock made up 32% of my account balance.

Unfortunately I didn’t have this 10% rule in place, but learned it the hard way. It can be tempting to pour money into a stock when it feels like rocket fuel to the moon; it can also be tempting to pour money into a stock as it crashes back down. I get that gambler’s feeling at the concept of buying the thing dirt cheap because “this time will be different”.

There’s another rule created right now – if you get the gambler’s rush about a stock or trade, it isn’t the right thing to do. This system is based on cool, collected precision, not trying to roll a hard 8.

3. Don’t trade unless you are making a good trade for a good reason.

I posted Monday about taking an intentional loss on 200 shares of Coreweave, a good trade for a good reason, but still a $4,000 paper loss. It turns out I really really do not like losing and knowing I would be posting this loss for the world to see clouded my vision for the rest of the week.

The market was choppy and my options contracts became valuable, especially on Thursday. Thursday I also happened to be on PTO from work and had idle time on my hands. Remember my comment above about the 1% plan being a “set it and forget it” system? I placed 17 trades on Thursday, generating over $1500 in profit.

I also placed an 18th trade at 12:55pm generating a $500 loss.

There is no reason whatsoever in the 1% system to ever place 18 trades in one day, never. So why did I?

With the benefit of hindsight I can see that there was a part of my brain thinking, hey you know I could probably make up that $4000 and not have to show a loss. Which leads to the next rule.

4. If you’re emotional about trading, walk away your computer. If you are still emotional after 15 minutes, run away from your computer.

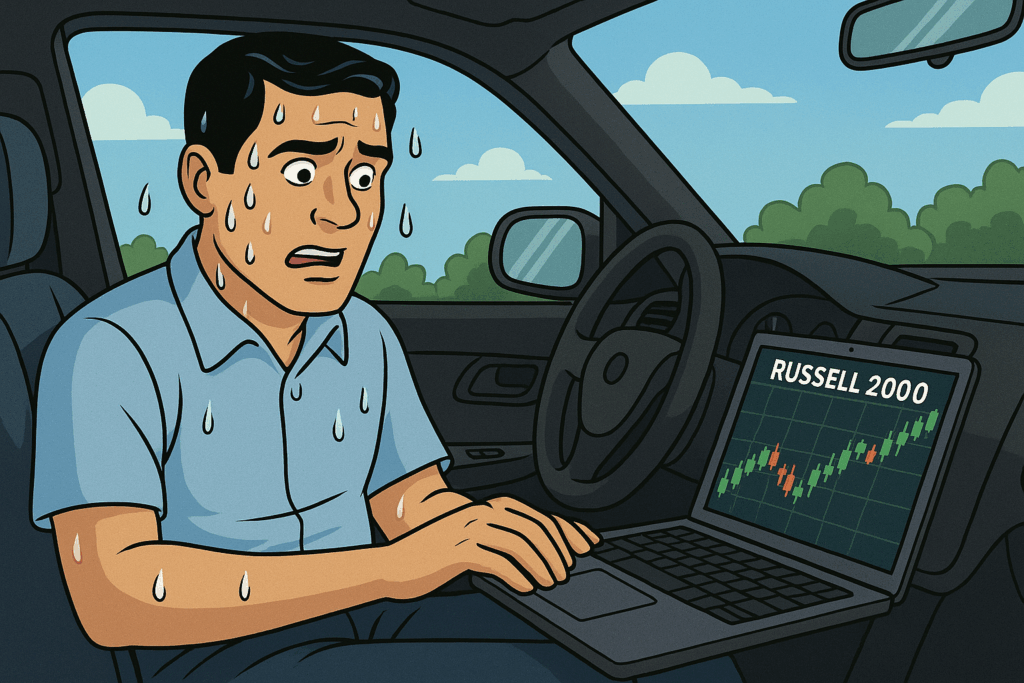

The 1% plan is pretty clear on the how, what, when and why of trades. I also got to this place by making a ton of errors. One of those errors is treating trading as gambling. I know when I am trading within the system and when I am gambling. This week I treated trades like gambles on 2 occasions, both trading the Russell 2000 at the buzzer, or what I dub “Blip Trades”.

Trading the Russell 2000 is predictable and steady, as I have explored. Trading the Russell at 12:55 is straight up gambling. And it happened twice.

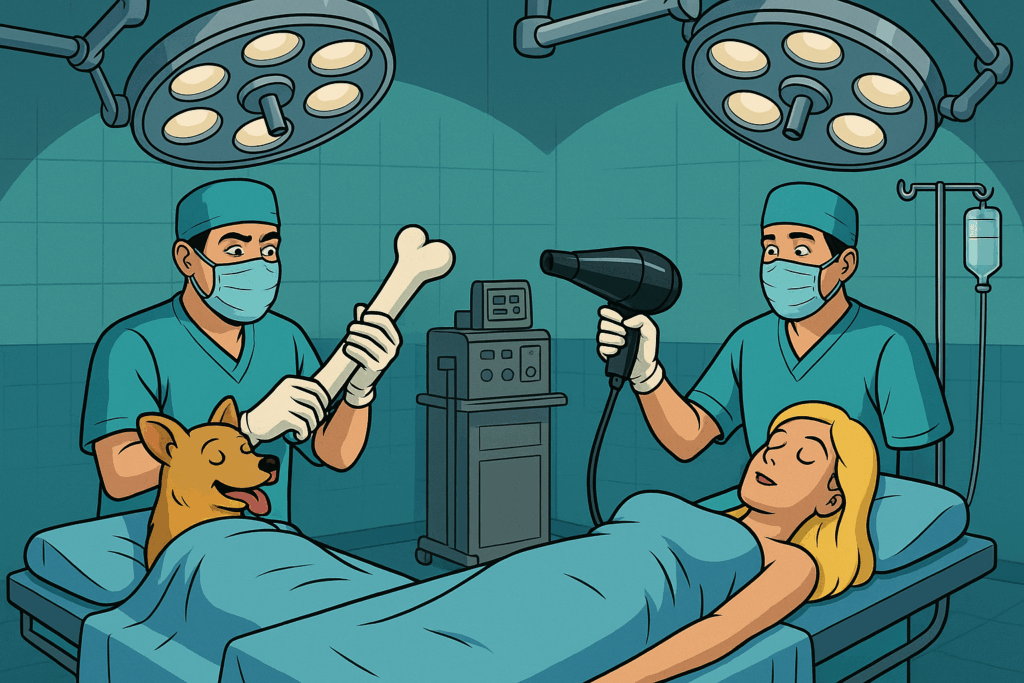

On Thursday I was on PTO as both my dog and my wife were in surgery at the same time. After dropping off the dog (priorities) I had the entire morning at home alone, with idle hands and an idle mind that was focused on that $4000 loss. That explains the 17 trades; those are explainable and profitable.

But at 12:30 I got a text that my wife and her parents were on their way home with Chipotle, landing them home at – wait for it – 12:55, exactly when I will execute a RUT “blip” trade if the conditions are right.

The conditions were not right. There were no clear indicators of where the number would land at 1, there was no option contract with crazy value and I knew deep down I was chasing.

True to their word, they walked in at 12:55, just as I placed my blip trade. So there we were – my wife back from surgery, my in-laws having taking their entire day to help her, me watching a number tick up and down like a madman. I am a good husband, but that’s not good husbandry. (I should probably look up the definition of husbandry). RUT blips up at the buzzer, I lose $500. I take an easy day, a profitable day, a day when I had already made $300 on the RUT and lose $500 at the buzzer all trying to roll a hard 8.

The next day, much the same. On a half day, left work after lunch to beat traffic to our desert home (I just like saying desert home, even though I don’t own any other home). At 12:50 I pull over, fire up the laptop, do much the same and? Lose $900. Again, in chasing a loss, in trading emotionally, in deviating from my own rules I took 2 good days that should have been profitable to the tune of $1500 and end up with a $100 profit.

The system works, but only I work it.

That all makes sense, so what happens next?

- Dilute Coreweave

- Limit trading

1. Dilute Coreweave.

Coreweave (CRWV) announced earnings on Tuesday after the bell, beating all expectations and the stock price responded by…plummeting.

Coreweave Earnings: I was very, very right about this one.

I wrote on Monday how I exited 50% of my Coreweave position when the stock crested $140. I took a loss as we will see below but now own 200 shares at $114 along with some favorable options contracts.

I was concerned about the exact scenario in which earnings were great, but not great enough. The wisdom of crowds and all that.

So my objective for this week is to lessen the focus on Coreweave since it appears I may be holding it longer than expected. The key is to now acquire stocks and options in other sectors to generate profit and reduce the impact of one stock.

2. Limit trading.

This week will be about establishing my trades today, placing them at market open tomorrow and leaving it alone. Trade when necessary. I have over $1500 in options premium expiring on Friday. There isn’t much to be done other than setting up 8/29 and September, as discussed below.

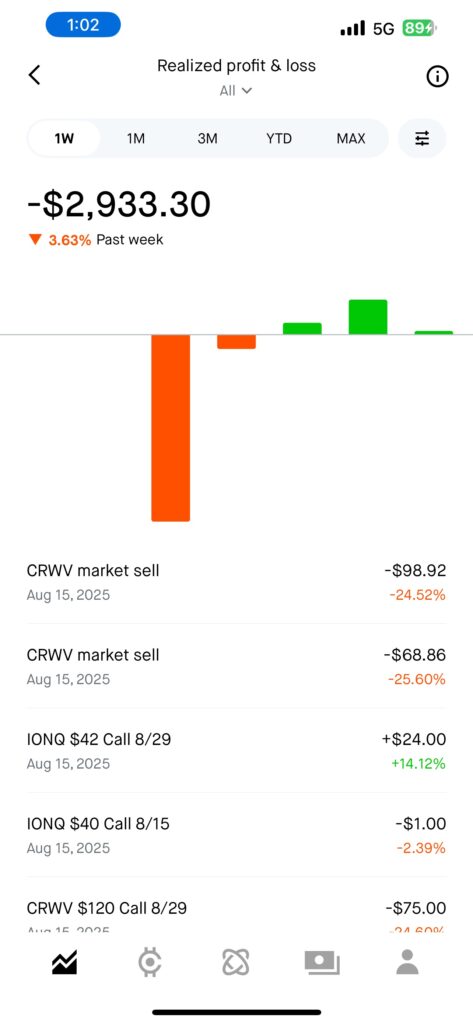

WEEKLY PROFIT: -$2,933

This was the first week realizing a loss but this was intentional. By dumping my 200 most expensive Coreweave shares, (i) I lowered my average cost to $114, (ii) I freed up capital to deploy elsewhere, buying an IWM to trade as well as 100 shares of COP in advance of Monday’s $95 dividend and (iii) I reduced my exposure to the very scenario that occurred, a steep drop after earnings.

It’s still painful to display a loss, but the prize is $100,000 at the end of 2025 and this was the fastest path in that direction.

WEEK END ACCOUNT BALANCE: $70,450

While my profit was in the red for the week, my account balance continues to climb, reaching $76,000 at one point before CRWV earnings, settling at $70,450. With a weekly goal of $72,000, I was not able to withdraw any funds but am in a good position for this week.

Last Week’s Notable Trades (-$2933 profit)

- CRWV – I have written extensively on all of the negative around CRWV but there was also a breakthrough positive. With the stock at $98, I sold 3 contracts for 8.22 at 110 that yielded $358 profit each. That’s $1074 guaranteed profit the week of 8.22 if I hold until Friday. More on that below.

- COP – ConocoPhillips is my 2nd gas/oil holding, along with XOM. This sector, like banking, is highly predictable and trades within a pretty tight band. COP is currently down $10 from its 2025 high and $40 from its all-time high. This predictability means lower options premium but a $95 dividend on Monday, August 18.

- RUT – Great week within the system, terrible week outside of it.

- IWM – IWM is an ETF derived from the Russell 2000 that trades options daily. I bought 100 shares at $220, traded a $222 contract and it shot up to $230, leaving me with a $400 profit ($200 for the jump from 220 to 222 and $200 for the options contract). Trading IWM is like trading the Russell 2000 without any of the risk, because the worst case is you end up owning it. So why don’t I just own 100 shares of IWM and trade those options every day instead of trading the RUT itself and risk losing cash? You can trade the RUT in $500 increments and make a good return, typically $100 for each $3000 you commit. Trading 100 shares of IWM requires $22,.000 and the return is around $100 per day. That being said, after the week I had with the RUT, IWM is looking like an attractive option (pun intended).

Next Week’s Trades:

Last week’s volatility and user error has restructured August & September. I shifted my options contracts from an even spread of ~$500-700 per week over 4 weeks to a more bunched up layout with over $1500 in options expiring this Friday and then less on 8/29. It then picks up again in September. So this week will be about setting & forgetting, rolling positions out a week and potentially losing CRWV & IONQ should they rise.

In advance of 8/25, I will keep my eyes out for a few key markers – (i) stocks to buy on a discount, (ii) stocks with exceptionally valuable options contracts, (iii) stocks with dividends in the next 2 weeks.

This last category is particularly valuable in my system because played correctly you not only earn the options premium but the dividend as well. For instance with COP trading at 96 and a $95 dividend on 8.18, I sold a $97 call for 9.5, generating $139 profit. Realistically I will collect the $139 profit, $95 dividend and own a stock that I can roll out later into September for another $140 or so.

The other stock I am targeting this week is Starbucks (SBUX). SBUX fits all of my markers but also has a couple of other things going for it. First, it is a stock I would own forever if I had to, unlike a speculative stock like a CRWV or IONQ (another big holding of mine). Also, SBUX just paid a dividend of $.61 on Friday and the stock dropped $1.86, technically $.61 of that drop is due to the dividend. So while I don’t get to earn that dividend, I do believe that I am buying SBUX at an equivalent discount.

Beyond this is the waiting game with CRWV. I have over $1000 in options premium on 3 x 110 calls for this Friday. My plan is to hold until Wednesday, see how CRWV’s price reacts and most likely roll 1 at a time to Friday, 8/29, collecting most of that $1000 in premium and generating another $1000 in premium for 8/29. I may be down $7200 on CRWV ($3000 actual loss plus $4200 in unrealized loss since my average cost is $114 per share) but it does not take an advanced degree in mathematics to see how quickly that can be made up at $1000 per week.

Next Week’s Goals

I am forecasting a $1200 profit goal by next Friday, depending on when and what I roll to 8.29.

My updated roster of Covered Calls:

| EXPIRATION DATE | CALLS | PREMIUM | REMAINING VALUE |

| 8.22 | CRWV 110 (* 3) | $358 (* 3) | $1074 |

| 8.22 | IONQ 40.5 | $133 | $149 |

| 8.22 | IONQ 41.5 (* 5) | $103 (* 5) | $525 |

| 8.29 | WMT 100 | $297 | $267 |

| 9.5 | COP 97 | $139 | $145 |

| 9.5 | XOM 110 | $76 | $84 |

| 9.5 | QCOM 150 | $246 | $123 |

| 9.5 | SOFI 22.5 | $102 | $72 |

| 9.12 | IONQ 43 (* 2) | $311 (* 2) | $408 |

| 9.19 | VSAT 16 | $145 (* 3) | $60 |

| TOTAL | $3,639 | $2,907 |

| DATE | BALANCE (BEG) | BALANCE (END) | BALANCE (GOAL) | DEPOSITS | WITHDR. | PROFIT |

| 7.3 | $60,000 | $62,500 | $60,600 | $740 | $1,470 | $1,200 |

| 7.11 | $62,500 | $60,500 | $63,125 | $830 | $0 | $4,900 |

| 7.18 | $60,500 | $63,500 | $65,000 | $850 | $0 | $1,350 |

| 7.25 | $63,500 | $64,600 | $65,000 | $540 | $0 | $2,176 |

| 8.1 | $64,600 | $62,000 | $66,000 | $450 | $0 | $1,741 |

| 8.8 | $62,000 | $71,000 | $67,000 | $590 | $2,200 | $1,806 |

| 8.15 | $71,000 | $70,450 | $72,000 | $650 | $0 | -$2,933 |

| 8.22 | $70,450 | $71,200 |