One particular stock has had too much of my attention for the last month, Coreweave (CRWV). I have written at length about my $12,000 profit since launching this project on July 1 with only a ~$2,000 overall bump in account balance.

That will happen when you own 400 shares of a stock that drops $50 from your purchase price.

I have also written about calculated patience and a plan to get out of this jam without taking unnecessary losses just to ease the pain, especially with earnings on tap tomorrow.

Today was the day.

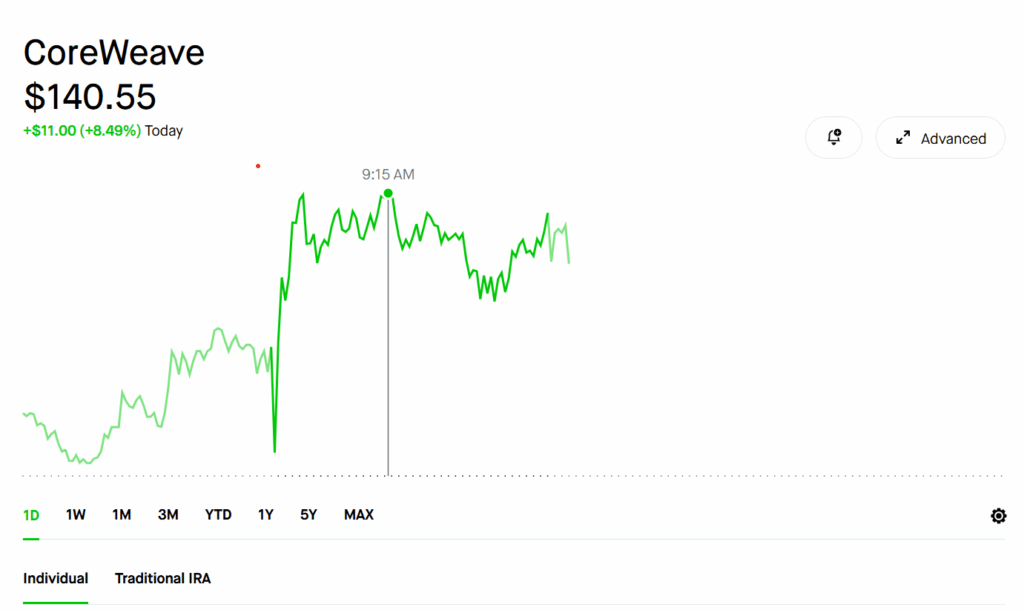

My Dollar Cost Average was at $134 (400 shares) and I had options contracts against all of them. Today the stock surged past $134 and hit $140 at its peak. Meanwhile my option contracts began to lose some value as volatility dropped with earnings so close.

So today I closed 200 shares and closed 2 options contracts – (i) my 8.8 124 contract. I took a ~$300 loss on this one; (ii) 1 of my 8.22 130 contracts, taking an ~$600 loss. I also took a $3000 paper loss on the stock itself, totalling a $3900 paper loss.

Why a paper loss? Because now I own 200 shares of CRWV instead of 400 and my Dollar Cost Average is now $122 instead of $134. So yes, I had to eat the loss for today but will realize a $4000 gain or more when I sell the remaining 200.

Why now?

After weeks of waiting, why now?

Coreweave is announcing earnings tomorrow and highly volatile companies like this tend to trade violently after earnings, shooting up and down 30% regardless of what is said. So there is that to contend with.

Also, the average estimate target price for Coreweave is $111 in one year. If I would have held and the price plummeted I would be stuck in this situation for some time.

If I would have held and the stock popped, I still would have had to sell 100 shares at 124 and 100 shares at 130, because of my options contracts. The only difference was the $300 loss I took on the 124 contract and the $600 loss I took on the 130 contract.

In the end I would have risked an account drop of $10,000 and months or more of dealing with this for $900. I chose peace and quiet that comes knowing I can make that $900 up in easier ways than watching and waiting one single stock all day.

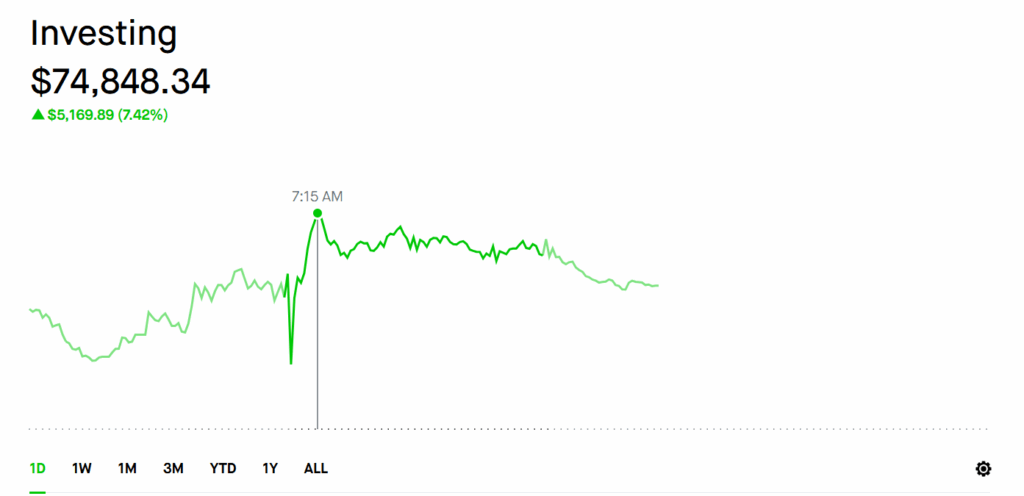

Finally the 1% plan projected an account balance around $68,000 by now. Today my balance flirted with $75,000.

My goal remains the same – $100,000 by December 31, 2025; $200,000 by December 31, 2026. Today’s trades were the fastest path to get me there.