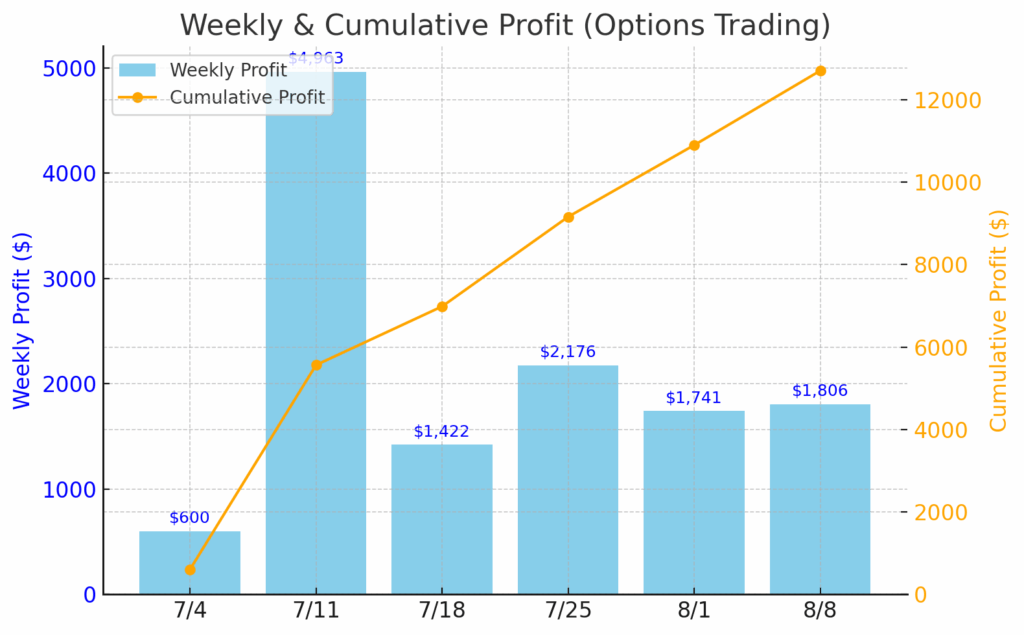

This is my 6th weekly check-in as I track my progress from $60,000 on July 1, leading to $100,000 at the end of 2025 & $200,000 at the end of 2026.

Every one of those weekly updates has featured a weekly profit beyond my goal.

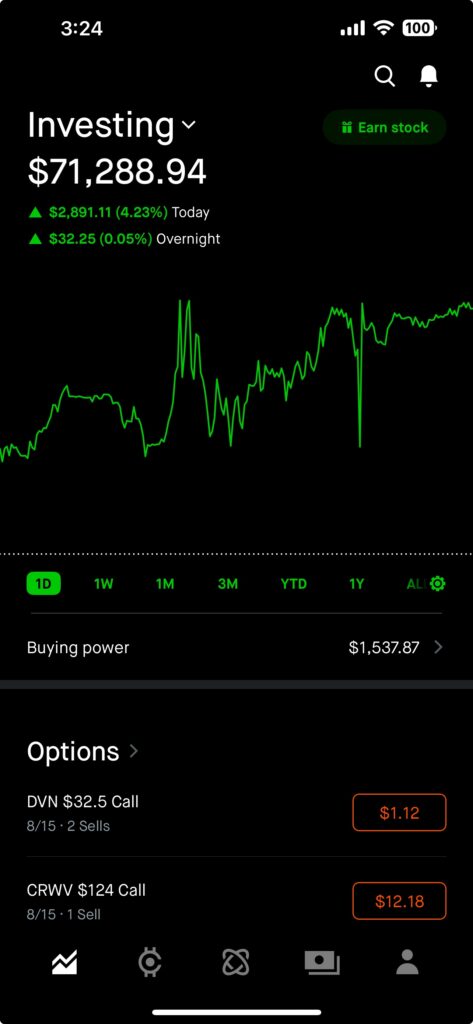

Despite over $12,000 in profit over the first 6 weeks, my account has languished in the ~$62,000 range and I have talked a lot about why, one stock – Coreweave – has managed to pull my entire account down.

I preached patience and trust in the system; I also described the emotional disconnect this created but I did not waver and I did not sell. This was the week that finally paid off.

Coreweave (CRWV) popped $16 this week for a couple of reasons way too boring to explore here. I’ll take it.

At the same time, the company reports earnings on Tuesday, with a forecast of -$.23 per share on revenue of $1.08 billion, which is basically Monopoly money. Coreweave is an AI company that has big, long-term contracts with most of the major companies.

Coreweave also expects to burn $20-23 billion on capital expenses in 2025 due to the cost of AI infrastructure and expects to pay roughly $250-300 million in interest expense in Q2 alone. I get stomach aches at my work about our expenses and lose sleep over the capital projects we are not able to do – imagine being the CEO spending $300 million in Q2 on interest.

All of this to say – I deeply regret getting so deep into this one position. Come Tuesday, this stock could shoot up making me look like a genius but there is a greater likelihood that the stock drops and that $71k account balance you see below drops right back down to $62-64k.

So what to do about this kettle of fish?

The $16 CRWV pop this week put me well into the black for my first month. In theory I could dump my CRWV holdings, take a major loss on that one stock but be in the black overall. Yesterday, a friend of mine asked me why I wouldn’t do that.

The issue there is the nature of option contracts. I own 400 shares and have 4 option contracts:

- 8/8 124

- 8/22 130

- 9/19 145

If I closed any of these out right now, I would take huge losses. That 8/8 124 option contract currently trades at over $1000 yet the stock is trading at $128; the extrinsic value of that contract is $400 (128 current price minus 124 strike price * 100 shares). So to close it would be to throw away $600 ($1000-400). Meanwhile the 8/22 130 and 9/19 145 option contracts are not even in the money and have a cumulative value of $3200 which is literally all profit.

If I closed right now, with everything I just laid out – I would lose over $5,000. So I hold.

CRWV is currently trading at $128 and my next CRWV option contract expires Friday at $124. After earnings on Tuesday, I expect the stock to rise or fall as much as $20.

If CRWV rises after earnings

If CRWV reports better than expected earnings, the stock could rise to 150 and all of my options will be In The Money. In that scenario, I don’t need to do anything. On 8/8 I will be forced to sell 100 of those shares at $124 but my average cost will drop into the $128 range. On 8/22 I will be forced to sell 200 shares at $130 and turn a profit on those and on 9/19 I would lose my final 100 shares at $145 and realize a major profit. Along the way, I will collect over $3000 in options premium.

If CRWV falls after earnings

If CRWV says even one thing that spooks Wall Street, the stock could easily drop to $105-110. In that case, my account balance will drop back down to the $63k range, but the $3000 in options premium will drop closer to $1000, a huge profit of $2,000 that I could recognize this week. I will continue to own my 400 shares at an average cost of $134 and continue to sell new options contracts against them.

My preference at this point is the CRWV rises scenario where I lose those 100 shares, bring my average cost way down, own 300 profitable shares and eventually lose those as well over the next month.

In the CRWV drops scenario I will most likely look at accumulating more shares to lower my cost, basically heading deeper into the crevasse (obscure 30 Rock reference).

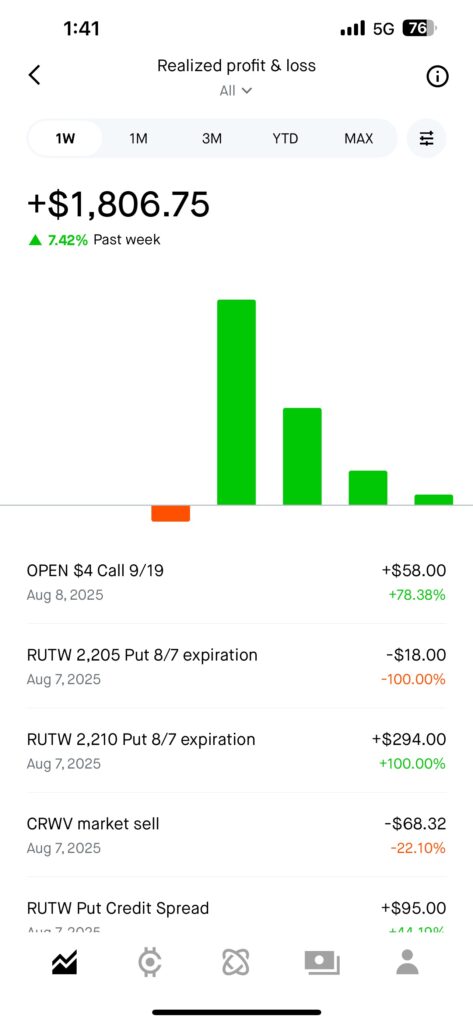

WEEKLY PROFIT $1,806

WEEK END ACCOUNT BALANCE – $71,288

Last Week’s Notable Trades ($1806 profit)

- QCOM – Qualcomm reported great earnings yet the stock dropped 5% due to items discussed during their earnings call (general tariff concerns, slight drop in their Automotive business and exposure to Apple creating their own chips). QCOM is a great stock, almost perfect for my 1% system; (i) it is steady, unlike CRVW we know it will never drop 50%, (ii) it is volatile enough to generate great option premiums, around $100-150 per week, (iii) it pays a great dividend ($89 per 100 shares). So this week I bought the dip and now hold 200 shares.

- DVN – got into 200 shares of DVN prior to earnings. People ask me how I pick my stocks. I begin with my screening process for options trading, but a lot of it is based on experience, some of it on feel and a tiny little sliver on sentiment. Devon Energy is based in Oklahoma City in a really weird scenario. There are two major energy companies (Expand Energy being the other) in Oklahoma City and they each have huge buildings for no real reason, one on either side of a river. I only know all this because I spent time there for work. They are wildly profitable companies that each pay huge dividends. It is a very odd scenario but they are both Steady Eddie stocks, so I decided to branch a bit more into Oil & Gas this week and traded 200 shares at $31.67 with an Options Contract on 8.15 at 32.5. The stock is currently at $33, so I will realize not only $150 in Options premium on Friday but the stock gain as well.

- RUT – Highly profitable week on the RUT ($700), despite a $150 loss on Monday.

Next Week’s Trades:

August is set up perfectly and September is taking shape early. There is not too much to do this week besides waiting for CRWV earnings. On Monday I will roll my XOM to 9.5 and on Friday my DVN shares will drop off.

I don’t plan to buy anything new this week, I am already overbought as it is and want to stockpile cash in case any of my stocks drop and I want to buy more.

Beyond this is the waiting game with CRWV. If it rises, there is nothing to do but wait and deal with a short-term loss on Friday followed by huge gains over the next month. If it falls, I enjoy short-term gains as I cash in those options but deal with holding this stock for a few more months. In the long-run I win either way but I would prefer to win in the short-run at this point.

Next Week’s Goals

I am forecasting a $800 profit goal by next Friday without CRWV. However, CRWV will have an outsized influence on my P & L. If it pops, I will show a loss for the week because I lose 100 shares at 124, probably a $2500 paper loss (remember my remaining 300 shares will all be profitable when I sell them). If CRWV drops, I will harvest around $2000 in options premium so my total profit will be in the $3000 range for the week.

Really, my account balance at the end of the week will depend on CRWV. I look forward to striking that sentence from my weekly updates.

My updated roster of Covered Calls:

| EXPIRATION DATE | CALLS | PREMIUM | REMAINING VALUE |

| 8.15 | CRWV 124 | $280 | $798 |

| 8.15 | DVN 32.5 | $136 | $68 |

| 8.15 | XOM 110 | $242 | $23 |

| 8.22 | WMT 101 | $624 | $140 |

| 8.22 | QCOM 149 | $185 | $248 |

| 8.22 | CRWV 130 | $268 (*2) | $1085 (*2) |

| 8.29 | IONQ 44 | $301 (*3) | $648 |

| 9.5 | IONQ 43 | $270 | $297 |

| 9.5 | QCOM 150 | $246 | $308 |

| 9.5 | SOFI 22.5 | $102 | $113 |

| 9.12 | IONQ 43 | $270 (* 2) | $690 |

| 9.19 | CRWV 145 | $275 | $948 |

| 9.19 | VSAT 16 | $145 (* 3) | $117 |

| TOTAL | $4,774 | $6,568 |

| DATE | BALANCE (BEG) | BALANCE (END) | BALANCE (GOAL) | DEPOSITS | WITHDR. | PROFIT |

| 7.3 | $60,000 | $62,500 | $60,600 | $740 | $1,470 | $1,200 |

| 7.11 | $62,500 | $60,500 | $63,125 | $830 | $0 | $4,900 |

| 7.18 | $60,500 | $63,500 | $65,000 | $850 | $0 | $1,350 |

| 7.25 | $63,500 | $64,600 | $65,000 | $540 | $0 | $2,176 |

| 8.1 | $64,600 | $62,000 | $66,000 | $450 | $0 | $1,741 |

| 8.8 | $62,000 | $71,000 | $67,000 | $590 | $2,200 | $1,806 |

| 8.15 | $71,000 | $72,000 |

Leave a Reply