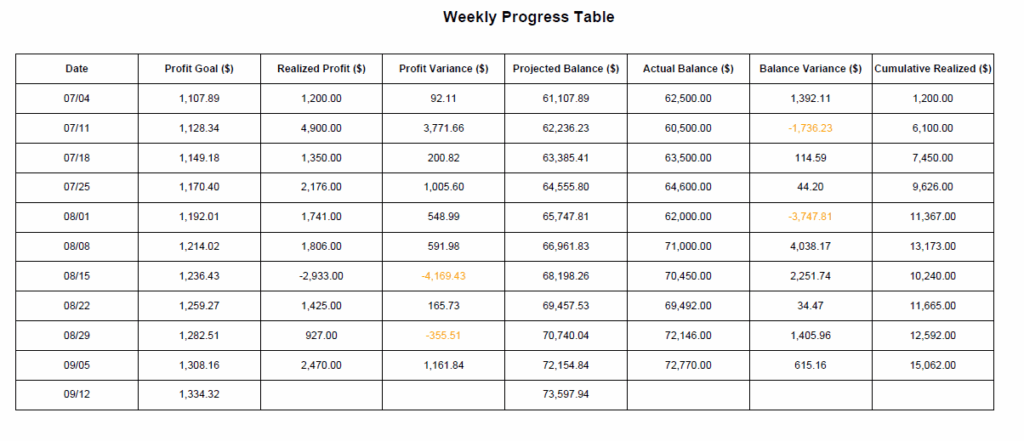

Weekly Profit: $2,470

Opening Account Balance: $72,146

Ending Account Balance: $72,770

Next Week’s Profit Goal: $1,334

Next Week’s ending Account Balance goal: $73,598

Notable Trades: Week of 9/5

Over a year ago my wife bought a week in Puerto Rico at an auction. Was there wine involved? Probably.

So we spent last week in a beach house cantilevered over the ocean.

The lady and I have taken plenty of trips before; some trips the trading doesn’t get in the way, some trips it does. One common thread, though, is that the only trading the glues me to a screen when I need to be present is trading the Russell 2000 (RUT).

Why? Because 95% of my 1% system is based on weekly covered calls, keyword weekly. Set it Monday and forget it until Friday.

The RUT, however, is daily and if you like, hourly, minute-ly and even second-ly. It’s quite possible to profit or lose hundreds of dollars in seconds. So unlike weekly covered calls, trading the RUT does require active involvement.

Therefore trading the RUT is the one thing I committed to not doing for the week. Puerto Rico is on Eastern Time (technically Atlantic Standard Time, but that’s not important) which means the market is open from 930am – 430pm. I didn’t want to spend my vacation and I really didn’t want to spend my wife’s vacation in a beach house in a Southeastern version of paradise – staring at a screen. Worse, staring at a screen and potentially getting very mad.

So the RUT was off the table for a week. I’d love to be able to honestly say I didn’t miss it, but it does tend to generate cash, so I missed that. What I did not miss, however, was the stress. This was a highly stress-free week.

This was also a highly profitable week, $2,470.

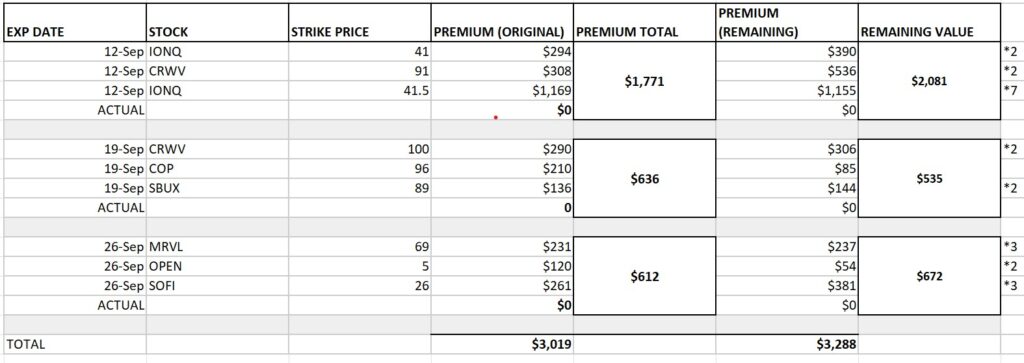

CRWV continued to languish, dropping as low as $84, ending the week at $88. I rode the wave down, generating another $1,100 from CRWV alone. I am so profitable on it that I am now trading 2 Near the Money calls for the nearest week and 2 Out of the Money calls for weeks in the future. It is now trading so low that most experts have recommended it as a buy, some with a 12 month projection as high as $200, average at $123.

The worst case is that the 2 Near the Money calls end up in the money when it eventually rises and I will still own 200 highly profitable shares. In that case I will show a paper loss for that week but will be sitting on thousands of dollars in unrealized profit on the shares I do own. I also believe at its current price of $88 it’s a strong buy and am slowly acquiring new shares to bring my Dollar Cost Average (DCA) price closer to $104.

Bit of a surprise profit on OPEN this week. Opendoor became the newest meme stock a couple of months ago, rising from a penny stock as high as $4, where it has hovered since. This week, however, it popped over $6. I had purchased 500 shares around $3.5 with $5 calls on it. I closed out of that position for almost $1,000 this week.

My other profit source this week was IONQ. I own 900 shares of it at a DCA of $41.40. Share price has been hovering between $40-42 for weeks; each week I am selling 9 contracts at $41.5 and generating around $1.40 each contracts. I typically close a little early and generate from $750-1200 each week. This is a great stock for covered calls right now. That said, I wouldn’t mind getting this position called away so I don’t get stuck with 900 shares on their way down.

Next Week

Next week is already set up with IONQ & CRWV alone. If they crash, my account balance will crash with them but my profit will be quick and easily exceed my weekly goal. If they hover or rise, they will likely get called away at the end of the week which would be just fine. This would free up $55,000 in trading capital and it would relieve my dependence on 2 stocks in the Tech/AI space.

My focus this week will be more of a focus on next week, the week of 9/19. Right now it’s looking a little empty, due to so much of my capital concentrated on this Friday.

Recommended Trades

9/12: MRVL 64. Currently trading at $63. You could get in on a distressed stock at a discount and worst case make $200 ($100 in options premium, $100 in the jump from its current price of 63).

9/19: VSAT 30: VSAT dropped this week from $33 to slightly below $30. I’d look at 9/19 VSAT 30 call that generates $180, an amazing .6% return in 10 trading days.

9/19: UNH. UNH finally popped this week from a low of $300 to $315. If I lose my CRWV and IONQ this week I will look at a UNH $325 for 9/19 that will generate UNH 330 call for 9/26 that will generate $450.

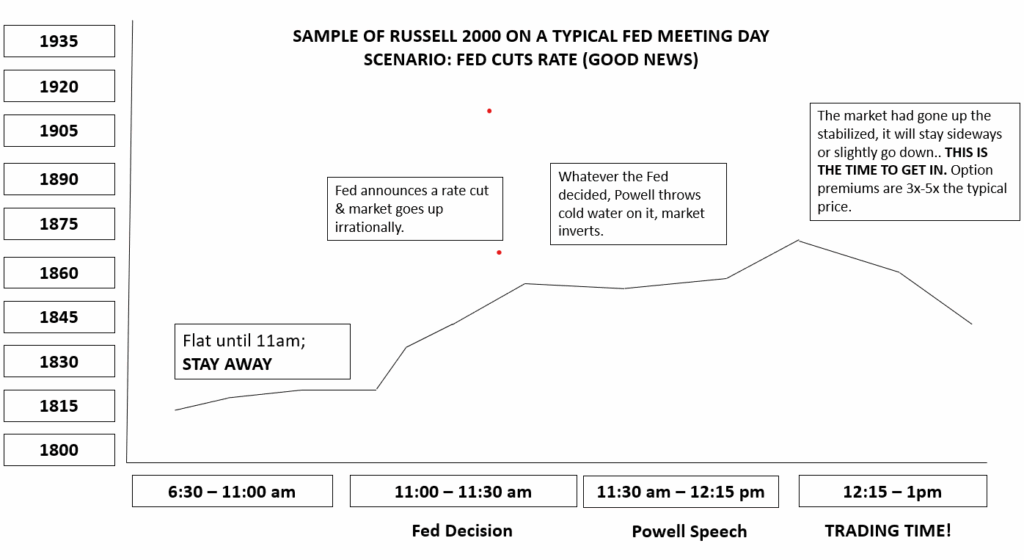

Looking ahead to the week of 9/19, Fed Meeting/Powell press conference on 9/17.

I suspect this week (the week of 9/12) will be a bit of wait and see. The market seems to be foaming at the mouth, 99% anticipating a rate cut of some kind; but the odds now stand around 11% of a jumbo rate cut, meaning more than 25bps. Powell has a history of waiting and seeing but has crossed the Rubicon and will make a rate cut. I don’t see him cutting more than 25 and I don’t suspect his press conference will be exciting enough to move markets up.

More than likely the market will like the rate cut, jump up from 11-1130am but will drop when he speaks. It typically looks like this:

We have a full trading week until then, so I will be watching and waiting. The week of 9/19 is a good week to not be overextended just in case – God forbid – Powell either doesn’t cut rates or strongly indicates this will be the only rate cut of the year.