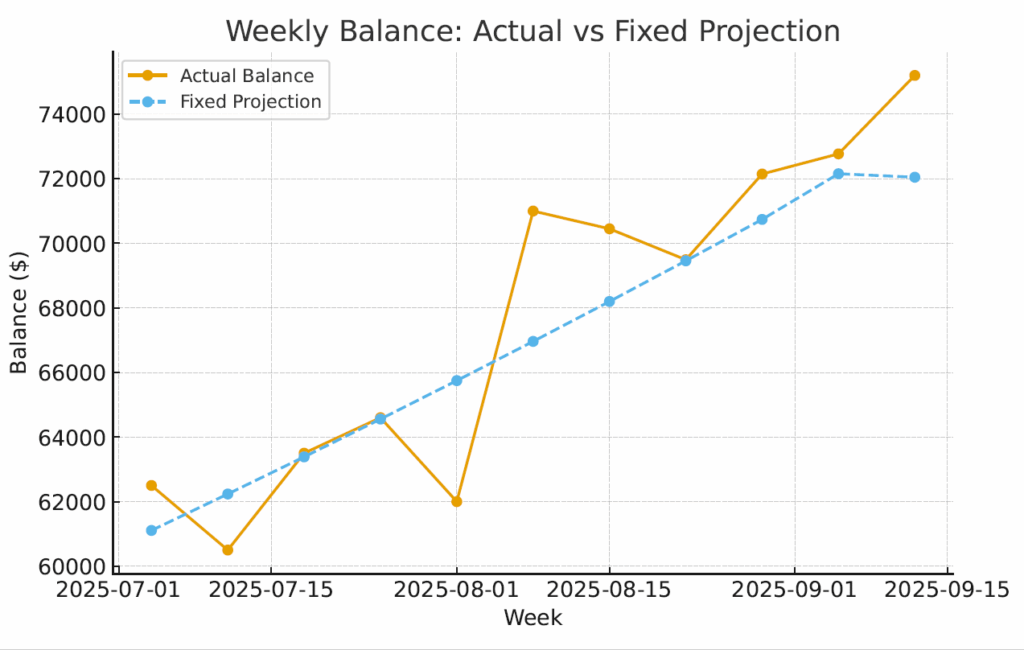

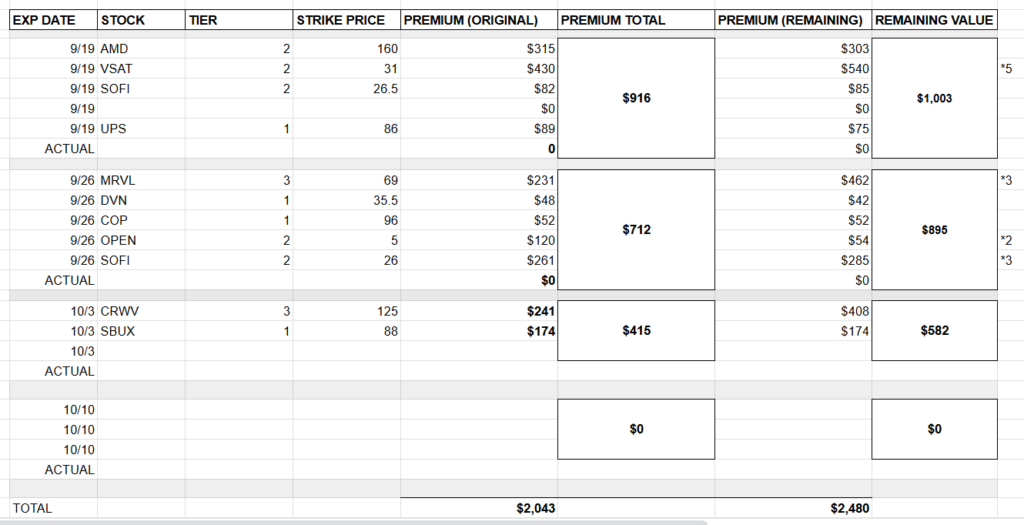

Weekly Profit: $-4,583

Weekly Profit w/o CRWV write-down: $2,215

Opening Account Balance: $72,000

Ending Account Balance: $75,200

Next Week’s Profit Goal: $1,388

Next Week’s ending Account Balance goal: $76,588

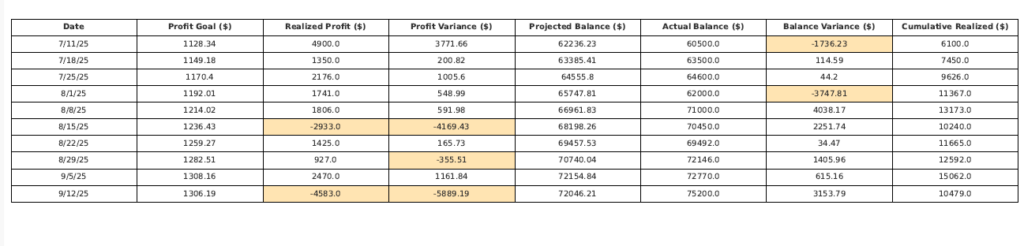

This Week’s Trades

Another week with profit and account balance decoupled.

On Tuesday, ORCL announced earnings. While earnings were down, the guidance around AI was incredibly bullish and all AI stocks moved in sympathy.

In two days, CRWV popped from $90 to $115. For better or worse, my gains were capped by the calls I sold. I decided to allow 300 of my 400 shares go and booked a $3000 paper loss while my account balance soared from $73,000 to over $80,000.

I was faced with a decision – I could let all of my CRWV holdings go and book a total $9,000 loss (on the 400 shares, not on all of the options I have made $$$ on) or I could hold some and use those shares to make that money back over the next 6 months.

I decided to book a loss on the covered call for my final 100 shares so I could hold on to them. 100 shares of CRWV is worth ~$500 a month in options premium.

I also now own those 100 shares at $89 average, so I am automatically sitting on a $2000 profit with CRWV currently trading at $110.

My plan is to hold on to those 100 and sell calls about a month out at a time in the 135 range, generating $500 or so per month. It won’t take long before I am right side up on CRWV and the rest is pure profit, because I will either keep making $500 per month, or CRWV rises to $135 and I book a $5000 profit.

I honestly don’t want to kick myself later when this stock soars to the $150 level where I believe it belongs over the next year.

Along the way, IONQ popped from ~$41 to $55 and all 900 of my shares were called off at a nice profit.

More than anything it is nice to be free of the incredible volatility of these 2 stocks, not to mention the account balance it freed up.

The Great Recategorization

I wrote last week about categorizing my preferred stocks into Tiers: Tier 1 (Low Risk, willing to hold forever), Tier 2 (moderate risk but willing to hold a year), Tier 3 (high risk, don’t like holding more than a week to a month). CRWV & IONQ were Tier 3, so when they were called off I was able to move into Tier 1 & 2 stocks. Some of my primary purchases:

- AMD – This is a stock I have been targeting for weeks but needed the account balance to open up. AMD is a Tier 2 in that it’s slightly more volatile than I’d like but kicks out great returns – $315 per week on a 160 call.

- DVN – DVN is a safe Tier 1 that I have written about before. To make any money here you need to own 200-300 and sell covered calls about a month in advance. I own 100 today but will probably bulk up next week.

- QCOM – QCOM is one of my favorites as it covers all the cases – volatile but not too volatile, great covered call money – $200 per week and if you hold it long enough, a good dividend as well.

- SOFI – Safely between Tier 1 & 2, I am now sitting on 400 shares which is my limit. I will keep selling calls 2 weeks out near my purchase price, which returns around $90 per week for each contract.

- UPS – UPS is a very boring Tier 1 stock, but after months of CRWV & IONQ it’s nice to have a stock that spits out $100 per week in options.

- VSAT – Right in between Tier 1 & 2, VSAT is volatile and trading fairly high but spits out $100-150 per month on each $3,000 you invest. I am up to 500 shares; when I roll my 9/19’s to 10/17 I am looking at an amazing $240 each on 10/17 31 calls.

Next Week

The next 2 weeks are going to be interesting, mentally at least. While Tier 1 & Tier 2 stocks are much safer and predictable, they also don’t produce nearly the income that Tier 3 stocks do.

Looking ahead I think the week of 9/19 & 9/26 are going to be relatively light as I recategorize my holdings and restructure how far out I sell my calls; like it or not I am going to need to depend on the Russell 2000 to generate around $500 in each of those weeks if I am to hit my goal.

Potential Trades to Watch

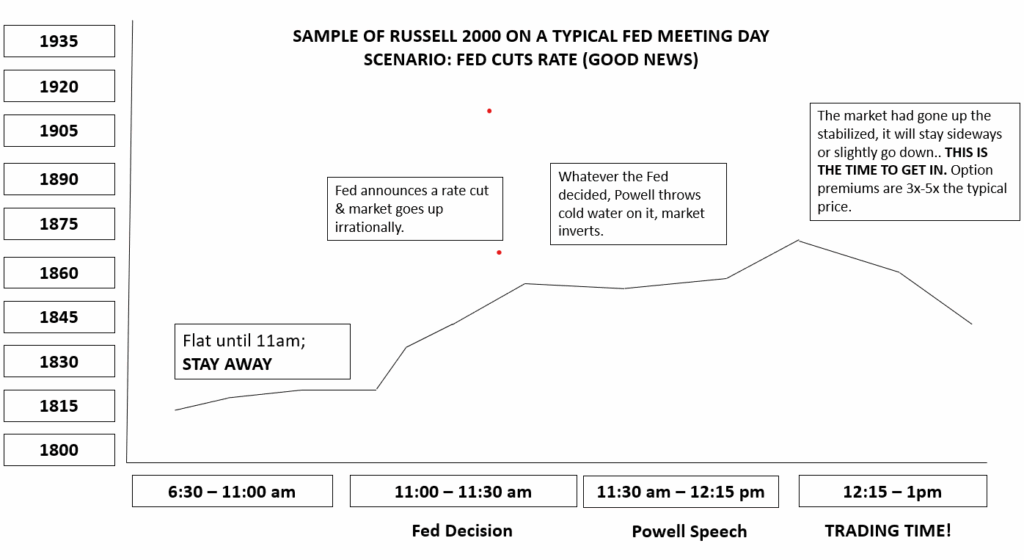

Fed Meeting/Powell press conference on Wednesday. I suspect this week will be a bit of wait and see. The market seems to be foaming at the mouth, 99% anticipating a rate cut of some kind; but the odds now stand around 11% of a jumbo rate cut, meaning more than 25bps. Powell has a history of waiting and seeing but has crossed the Rubicon and will make a rate cut. I don’t see him cutting more than 25 and I don’t suspect his press conference will be exciting enough to move markets up.

More than likely the market will like the rate cut, jump up from 11-1130am but will drop when he speaks. It typically looks like this:

As I slow play the Fed Week while also restructure my account, I am eyeballing stocks to buy on the cheap depending on the outcome of that meeting.

In the Tier 2 category, I am really looking at two key plays which will cost a cumulative $100k, so they won’t be happening overnight: (1) an index fund that trades options daily, specifically IWM and (2) a more expensive Tier 2 stock with high returns, such as ORCL or META.

This week will be about patience and preparation.