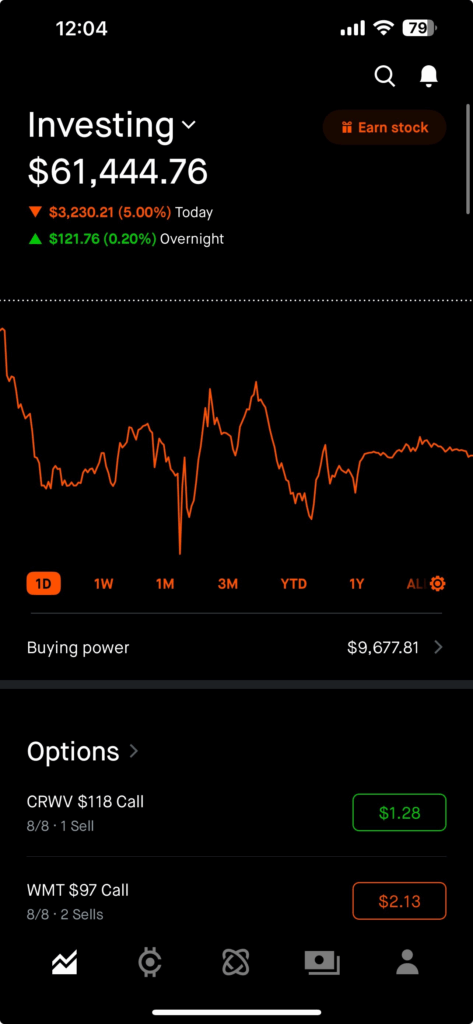

I launched this site on July 1 with intention – (1) to track my journey from $60,000 to $200,000 by December 31, 2026; (2) to provide a roadmap for others to pursue their own, similar paths; (3) to track my triathlon journey as I navigate aging as well as the health concerns that come with aging. Focus has been on the first two and the third one is coming over the next few months.

As I check in on my first month, I see a new unintended consequence: I have become more methodical and precise in my trading because of the accountability that this blog brings.

I heard it said about Olympic athletes – 80% of competitive athletes love to win and 20% hate to lose. The Olympians are in the top 10% of that 20%. And that’s me. I have been diligent and transparent about posting my wins and losses and honestly, I don’t want to post any losses, so I work very hard to not lose.

So where the heck am I one month in?

The results from July are schizoprenic, or more accurately a split personality.

The core of the 1% plan is to generate 1% profit per week; over the course of 18 months this will turn $60,000 into ~ $200,000. Allegedly. We’ll explore allegedly in a minute.

In terms of the profit for my first full month, 1% weekly would amount to $2430 ($600-$606-$612-$618); I annihilated that goal, generating $9474 total. Great success, right?

That is realized profit, meaning it’s free and clear. So if my beginning balance was $60,000 and I generated $9474, you would think my July ending balance would be $69,474. You’d be wrong. Remember I said allegedly?

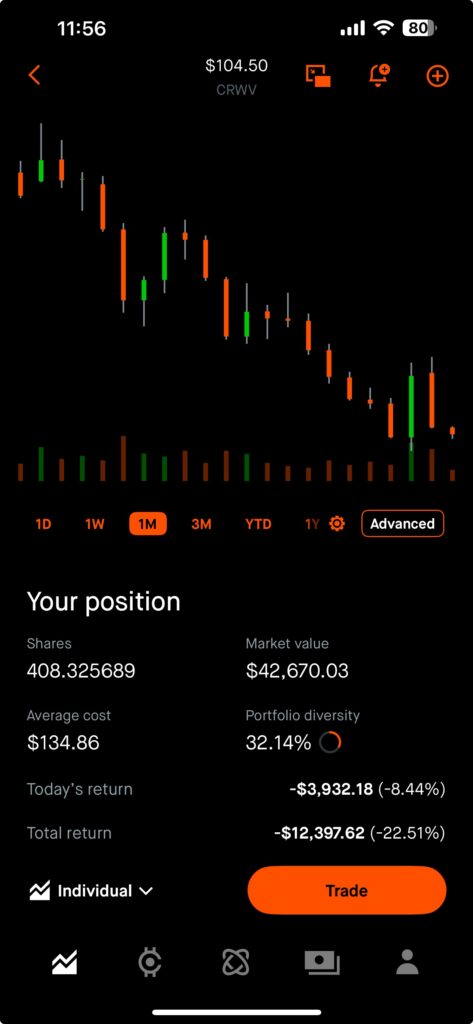

I have written about one of my particular holdings, Coreweave. I got into Coreweave in its IPO at $40 and got out at $120 generating huge profits along the way. However as it continued its ascent I got back in at $140. It hit $180 at one point but over most of July has cratered, ending the week of 8.1 week at $104.50. My current Dollar Cost Average is $134.80 over my 408 shares, so that equates to a loss of over $12,000. That’s a paper loss only; it doesn’t become a realized loss unless I sell.

I will admit – this is weighing on me. To generate $9474 in profit but my account balance to be close to the number I started with in July? It’s mentally draining, depressing really. Remember the “I hate to lose” part? It feels like losing. There are moments of – why am I bothering? or do I really know what I am doing?

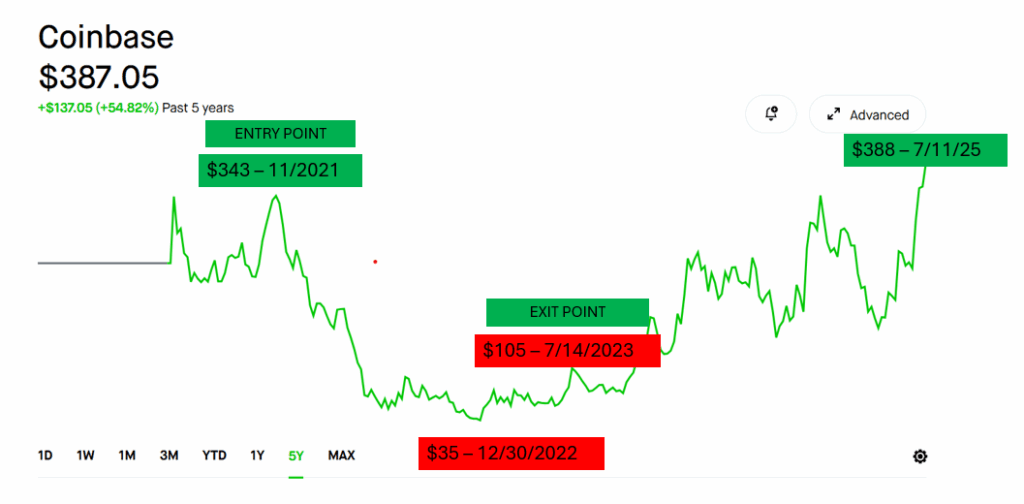

But also remember what I wrote above about this blog holding me accountable, so I go back to an earlier post I wrote about my experience owning Coinbase in 2021. As a reminder:

In 2021 I got into 200 shares of Coinbase at $343 only to watch it crumble over the next 2 years, hitting a low point of $35 in 2022. In 2023 I got out at $105, taking a $48,000 loss only to watch it essentially climb for the next 2 years. In the end, if I would have held it I would be up $8,000 instead of down $48,000.

There are lessons and regrets there. The regret is getting so deeply into 1 stock when my available capital was so low. I was into that stock for roughly 95% of my available capital so every swing and every downturn mattered. The lessons? There are a few.

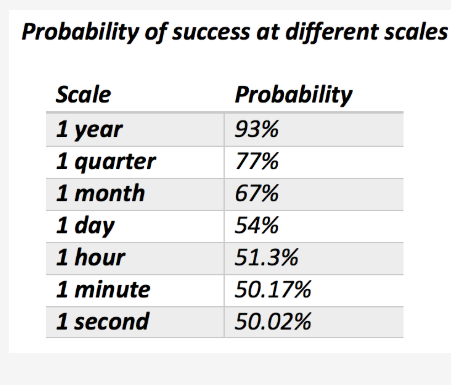

Lesson 1 – Don’t look at a stock every day.

Nassim Taleb has written on this topic extensively but illustrates it directly in Fooled by Randomness. He illustrates the story of a dentist who aims to earn 15% annually and is pretty good at it, so good he has a 93% chance of hitting that number.

However – the important part here is that the 93% probability is over one year. The more often he checks the status, the lower the probability. I suspect this is what I am going through here. Now my system is predicated on trading weekly options, so one year is not practical. However, given the vicissitudes of the market and of life – checking CRWV every 5 seconds is actually less practical.

“When I see an investor monitoring his portfolio with live prices on his cellular telephone or handheld, I smile and smile. “

Nassim Taleb – Fooled by Randomness

Lesson 2 – Be prepared to hold a stock. For longer than you’re comfortable.

Maintaining a portfolio based on trading options (especially Covered Calls) is a different scenario than buying and holding stocks for years. You may own a stock for days or weeks, rarely months and almost never years. This changes the calculus of what you buy and when and it also changes the mix of stocks you buy. However, as I am learning the hard way, every once in a while you get stuck.

I have written before that there are very few downsides to Covered Calls, but there is one major downside – the risk that the stock itself drops. When that happens you can continue to sell Covered Calls against it, but your weekly or monthly income will drop. If I own Coreweave at 140 and it drops to 105, I can either sell Covered Calls at say 110 for that week and make $150-200 but I run the risk that the stock price jumps over 110 and I end up selling it at 110 which means realizing a $3000 loss (140 purchase price minus 110 sale price times 100 share). Or I can sell say 130 calls for three weeks from now and generate $200, but I have to sit and wait for 3 weeks. If I want to sell say a 140 call, I probably have to wait 4-5 weeks.

Again this is still low risk as you don’t actually lose anything in this scenario but you do have the opportunity cost; what could you have done with those funds if they weren’t tied up in a diminished asset.

Lesson 3: There is middle ground.

I tend to be an all or nothing thinker so when it comes to this Coreweave scenario I default to binary extremes; either sell it all and take a $14,000 loss or buy as much as possible to lower my Dollar Cost Average. The reality is that these are not my only two options and frankly neither are great.

Selling it would be stupid because over a long enough timeline it is likely to go back up, at least much closer to my purchase price.

Buying as much as possible would be stupid because I become completely overleveraged on this stock, my moods become connected to how it rises and falls and in the end I run the risk of running out of capital to keep my 1% plan alive.

No, the middle ground looks like this. First, keep selling Covered Calls against it. Since I can sell four, my plan is to always have one 7-10 days away that’s relatively low priced, meaning there is a chance it could get called away. For example, if the stock is at 105, I sell a 115 for next Friday. I get around $150 for that and view that even if the stock goes up to 115, that means my account balance rises $4000 (10 dollar price increase times 400 shares).

Second, keep adding a slow trickle of shares, around 3 per week. This lowers my Dollar Cost Average around $.10 for each share I buy, but this leads to the third part of the plan. If the stock jumps say $5, sell all of those new shares I accumulated above the 400. Stock gains and losses are calculated via the FIFO method – meaning the first stock price I paid when I opened the position is considered the Sale Price when I close it. So if I originally bought Coreweave at 140 and I acquire new shares at 105, and I sell at 110, FIFO means they will presume I sold those original shares at 140. This does mean taking a few micro-losses (say 5-10 shares at a $30 loss per share) but it also means that my dollar cost average will drop a lot – say from 140 to 130.

Lesson 4 – Dilute the impact.

Along the lines of lesson 3 above not holding too much of one stock comes the flip side – hold many other stocks. A big chunk of the 1% system is diverting as much free cash into my account as possible, sometimes daily, sometimes weekly. Every deposit dilutes the impact of this Coreweave just a little bit. Right now I own $40,000 worth of Coreweave and that is a large chunk of $62,000, but every deposit, every week of profit, every RUT trade generating $150 mutes the importance of that. $40k of $62k is a lot and causes me stress; $40k of $100k is still too much but much more manageable.

Lesson 5 – Stick to the plan.

The 1% plan is about profit and loss. Yes, there is a stated goal of $200,000 by December 31, 2026 but the building block is the 1% weekly profit along with as many deposits as possible. While it is painful to the ego to watch the account balance languish, there isn’t anything I can about it today, for all of the reasons listed above. The weekly profit, however, I absolutely can do something about and am well positioned for August and beyond.

To be sitting here on month in, at $61,400 account value on a paper CRWV loss of $12,000 and a one month profit of $9,474 tells me I am on the right path. If you removed CRWV from the equation, my account balance would be around $73,000. The only one that can derail my plan is me. It’s probably best if I don’t overcook this egg and follow the plan. Time will prove me right.

Leave a Reply