The week of 8.18-8.22 could be described as a rebuild. A rebuild that didn’t require a teardown first.

I wrote last week about my first posted loss and the downstream psychological effects. It turns out that my mood was more tied to this process than I’d liked; it was healthy to confront this, so I discarded the old way of thinking and asked myself: Is this really the best way to be approaching this, attaching “success” and “failure” to any of this, let alone to variables I cannot control, like account balance.

The answer is no, this is not the best way.

What happens now?

I asked if I am looking at this wrong by focusing on the variable that I cannot control (Account Balance) instead of the variable that I can control (Profit & Loss).

I learned a while back that tying my self-worth to any outcome is a guaranteed one-way ticket to depression; the focus has to be the input.

This 1% Plan is about an outcome; I began with $60,000 and my goal is $250,000 in 18 months, that’s an outcome. Also that big number is comprised of dozens of stocks and options doing hundreds of things at any given moment; therefore it will swing wildly week to week due to factors beyond my control.

The 1% Plan is also based on generating a target profit number each week based on the analysis I perform, the decisions I make and the actions I take. That is my input. That is very much within my control.

Therefore focusing on my the Account Balance (outcome) is incorrect; focus needs to be on the weekly profit & loss (input).

This may seem obvious but sometimes I take the long road to obvious and as this crystallized I knew I needed to update my toolkit along with my thinking and ran this by my trusted friend Chad(GPT).

A snippet of my 8/20 conversation with Chad:

Me: I want to update my weekly tracker, but first a question: how to handle the inevitable situation i face where in any given week I achieve that profit goal but my account balance drops because certain stocks drop in value?

Great question — and it’s one that every options trader who tracks performance against a growth plan eventually runs into. Let’s break it down into why this happens and how you can handle it in your tracker:

I’d suggest you track profit goal vs. realized profit as the measure of whether you’re succeeding in your system, and treat account balance as a separate health check.

That way:

- You aren’t punished in your plan for unrealized swings.

- You can still hit your weekly “scoreboard” profit even if stocks temporarily drag the balance down.

- By December 2026, realized profits should carry the account to (or very near) $250k — stock swings will just be noise along the way.

On a personal level, it was helpful to realize that I am not the only one looking at the wrong KPI.

On a practical level, I needed to go back to the drawing board on my toolkit and that led to my new & improved spreadsheet.

Practically speaking this led to a very complicated spreadsheet, one above my pay grade.

Why this spreadsheet?

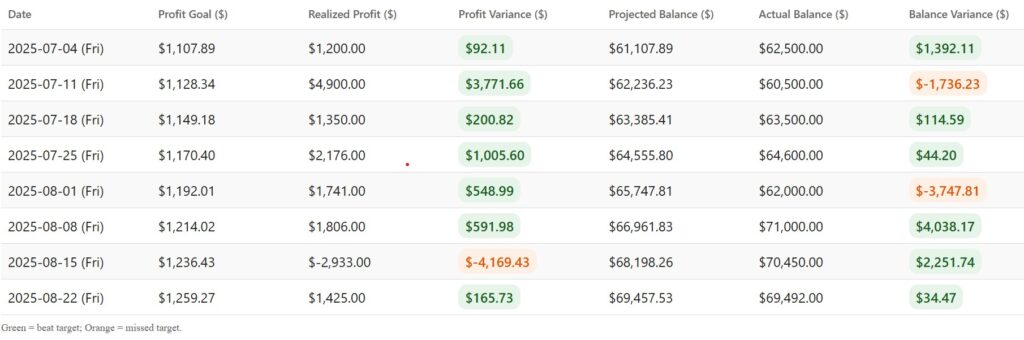

I have been on the right track in these first 6 weeks, but measuring the wrong things, getting caught up in account balance swings, reacting emotionally when stocks dipped, even if I had just locked in a solid profit. That mismatch — focusing on the balance instead of realized profit — created frustration and sometimes led me to over-correct.

This spreadsheet flips that. It forces me to track what I can actually control: realized weekly profits. My trades either generate income or they don’t, and that’s the only KPI that matters week to week. By anchoring to realized profit, the spreadsheet keeps me disciplined, no matter how the underlying market is bouncing around.

How does it work?

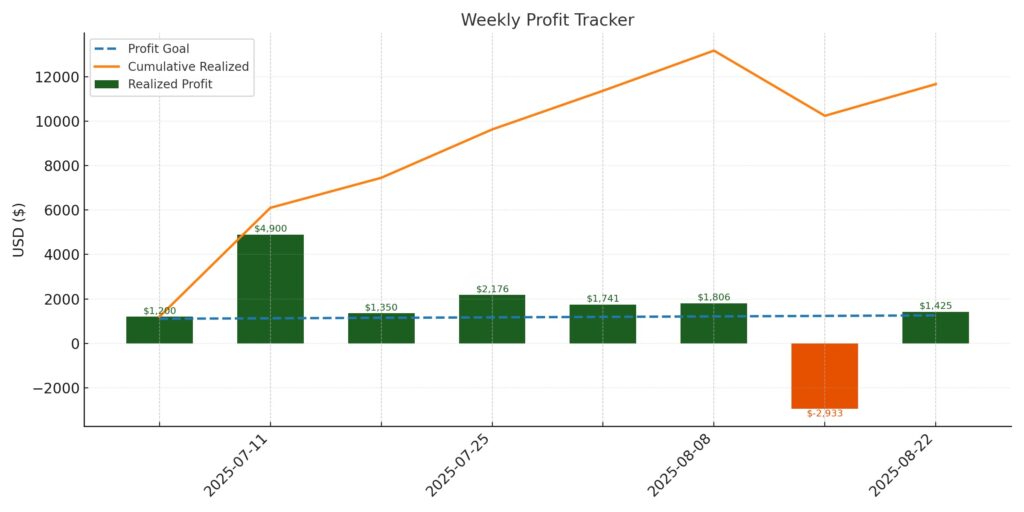

At its core, the spreadsheet projects a path from $60,000 to $250,000 over an 18-month window. It uses a compounding model that slowly increases the weekly profit goals, rather than asking me to hit the same number every week. This makes sense, because as the account grows, my capacity to take slightly larger positions grows too.

There are actually two models built into it:

Fixed Projection: This assumes I never adjust and just stick to the original growth path, regardless of what happens in the market.

Adaptive Projection: This one recalculates each week based on my actual balance, spreading any catch-up (or extra cushion) evenly across the remaining weeks.

The spreadsheet tracks both, which means I can see not only how I’m performing against the plan I made at the start, but also what it will take to get back on track if my account balance drifts off target.

How It Works

Each Friday, I enter two numbers

1. Realized Profit (what my trades actually produced), and

2. Actual Balance (what my account closed at).

From there, everything else updates automatically:

- Cumulative Realized Profit (how much I’ve earned to date).

- Profit Variance (whether I’m ahead or behind the weekly goal).

- Balance Variance (how my actual account compares to the projected curve).

It’s simple — just two numbers — but powerful in what it delivers: a full picture of both my trading execution and my long-term trajectory.

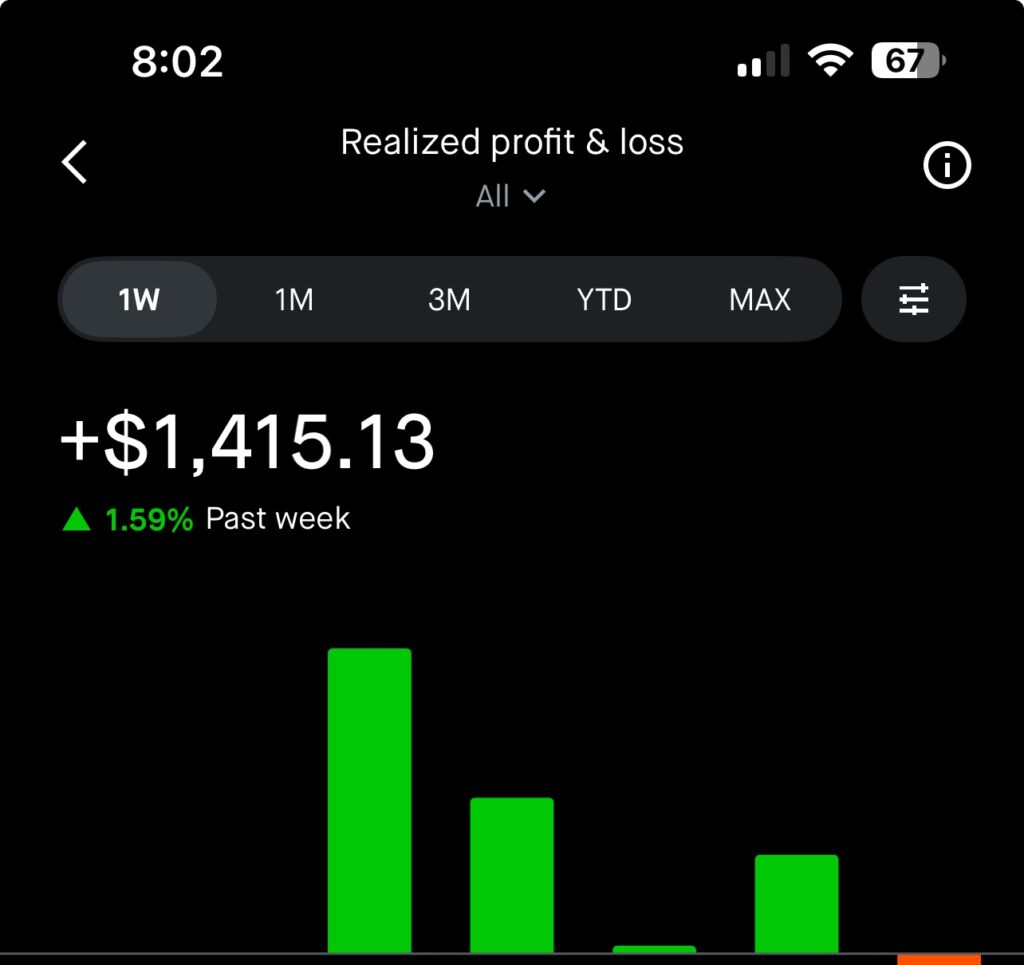

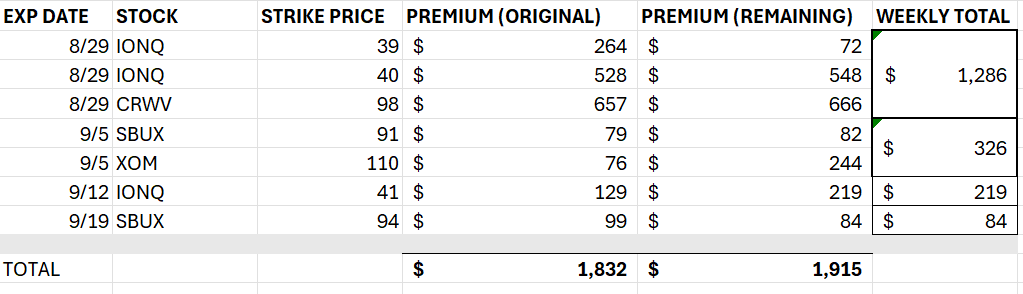

Last Week’s Profit: $1415

Last Week’s Notable Trades

Learned from the mania of the week prior to set it and forget it. Built my trades for the week on Monday morning and for the most part stayed out. Looked to the RUT for some extra cash, but the volatility was too insane and unpredictable.

Opened and rolled several CRWV & IONQ positions to generate over $2000 in profit this week and took the same approach to each, because I am in the same position with each – I own a little bit too much and find myself a bit too exposed. So for each I sold a Near The Money position for next week that would generate a manageable loss and then sold Out of The Money positions for the coming weeks at a price I’d be comfortable selling the position. In each case I am keeping a separate log of Options Premium I am generating each week which lowers the price at which I’d sell.

I also began entering into UnitedHealth (UNH). If you haven’t paid attention this is an interesting play. UNH is a good stock to own fundamentally but has experienced a crazy year, which includes the assassination of their CEO.

Beyond that, it has been a turbulent year and the stock is now almost 50% from its 1 year high. In the last week or two large institutional investors have begun pouring back into the stock and the target 12-month forecasts range from $300-450.

The Options Premium is insane, roughly $300 per week.

I have been slowly acquiring a few shares per day with the intent to own 100 shares by end of September and begin trading options against it. I am cautious because it is much pricier than most of my other holdings, giving it an outsized influence, but this is partly why I am acquiring so slowly and methodically.

Next Week

Friday was a frenzy on the market as Fed Reserve Chair Powell gave the keynote at Jackson Hole, hinting at interest rate cuts in September. Markets responded with a huge spike and most of my Covered Calls that we are Out of the Money or Near The Money are now In the Money.

As a result, next week may be waiting as CRWV & IONQ get called away after the bell on Friday. I may end up with a ~$1,300 actual gain but a paper loss as each of those stocks will sell for slightly less than my average cost.

No matter; I have generated thousands of dollars in Options Premium on each; furthermore I will own some holdings of each that will suddenly be very profitable.

It’s a real win-win.

If the stock prices stay level or rise, I will collect the $1,300 in premium and release around $56,000 in trading capital for 9/5 & beyond.

If the stock prices fall and they end up Out of the Money, I will actually be able to roll them out 1 & 2 weeks and generate healthy options premium for 9/5 and beyond.

Speaking of 9/5, I am light in the coming weeks and need to deploy capital there to bolster those weeks.

Trades to look at for 9/5: SOFI 26’s paying $65 and SBUX 90’s paying $109, UNH 310’s paying $600.

Trade to look at for 9/12: SMH 300 paying $515.

A great trade to look at for 9/19 are VSAT 30’s that are paying around $120. I may trade 2 or 3 of these.

This week is about patience and preparation for the weeks ahead.